PAIR Finance continues expansion with launch in Spain

Berlin, 4 April, 2024 – The leading provider of AI-based debt collection, PAIR Finance, which already works with more than 550 international companies, is continuing its growth across Europe: The fintech company launched in Spain this week. Business partners will benefit from an all-in-one service that significantly simplifies the processing and handling of receivables management in several markets.

PAIR Finance launches in Spain at a time when the country of 47 million people is rapidly going digital. Spain was recently ranked seventh in the DESI index, ahead of countries such as Germany and France. In terms of payment methods, the local payment method BIZUM is gaining in importance alongside credit cards. Consumers place particular importance on convenience, privacy and security when paying online. This also increases the desire for a new standard in debt collection, towards an efficient service and a customer-centric payment experience.

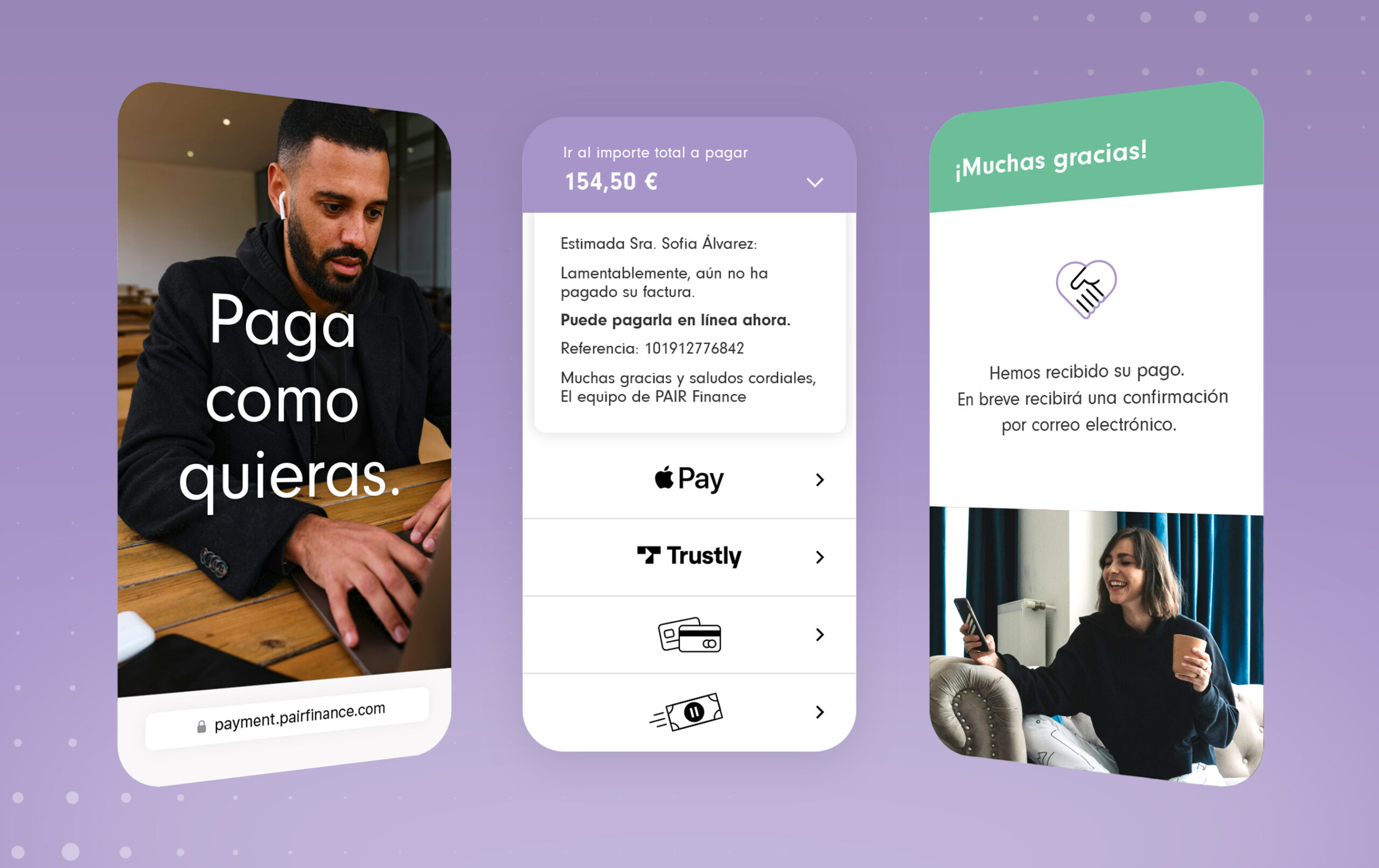

PAIR Finance’s entry into the Spanish market is a significant response to this growing demand. Thanks to the use of the latest AI technologies, the fintech is the first to offer comprehensive digitalised communication that is individually tailored to the needs of consumers. Innovative channels such as email or messenger services and a wide range of digital payment options ensure a smooth and pleasant experience with a high level of customer satisfaction. It is up to the consumer to decide whether to use telephone support.

“As the European technology leader in the debt collection industry, we are thrilled to announce our entry into the Spanish market,” explains Stephan Stricker, founder, and CEO of PAIR Finance. “We have already received an overwhelming response during the initial preparation phase and have been able to acquire our first business customers. The future of debt collection undoubtedly lies in the use of AI. With our unique, personalised payment solution, we are empowering consumers to take control and pay their debts on their own terms. When and how they want to pay, we are there for them.”

Part of PAIR Finance’s internationalisation strategy is the One Approach for corporate clients, a holistic approach to international receivables management. For companies, managing collections in multiple countries typically means contracts with multiple service providers as well as multiple data interfaces, contacts and reporting sources. PAIR Finance’s One Approach consolidates the management for the client, making it more convenient and efficient: with one contract, one integration, one reporting system and one application.

“The demands on finance teams are growing enormously. That’s why we want to offer digital debt collection with minimal effort for companies in Europe,” says Robert Frederik Witte, Director Corporate Development at PAIR Finance. “With the One Approach, we’re giving our business customers time back to do what’s really important.”

The German technology company, which was founded in Berlin in 2016, started its European expansion in Austria in 2021. In May 2023, PAIR Finance announced its entry into the Dutch market. Belgium, France, and Switzerland followed. With the launch in Spain, the fintech continues its growth trajectory in Europe and is now present in seven European countries.