Making debt collection customer-focused and efficient: How AI and Personalisation Improve the Customer Journey

This is the influence of customer journey and customer experience.

The customer journey describes the entire process that customers go through – from the first contact with a company to the purchase decision and the post-purchase phase. In recent years, the customer journey has changed significantly due to increasing digitalisation and the associated changes in consumer behaviour.

All interactions that customers have with a company and how they perceive and evaluate them represent the customer experience (for short: CX). It can be positive or negative and has a significant influence on customer loyalty and purchasing decisions.

A positive customer experience can contribute to customers making a purchase decision and subsequently building a long-term relationship with the company. After all, 80% of customers consider their experience with a company to be just as important as the products or services offered (Netigate Report 2022). Conversely, a negative CX can lead to a loss of customers and damage the company’s image.

Especially in view of the uncertain and tense economic environment, in which consumers have to budget very carefully, there is a threat of more payment defaults (Handelsblatt). Companies should therefore continuously analyse and optimise the customer journey and the customer experience in order to achieve a positive perception and build long-term loyalty. This also applies to finance teams, because many customer contacts take place in the finance process.

The role of AI and personalisation in the successful collections customer experience.

When customers do not pay, this can have various causes. For example, financial difficulties, dissatisfaction with goods, services or contracts, or a forgotten invoice. But this is not the only determining factor. It is also important to understand that every person reacts and thinks differently. The better we know a person, the more data and clues we have at our disposal, the more specifically we can approach the person.

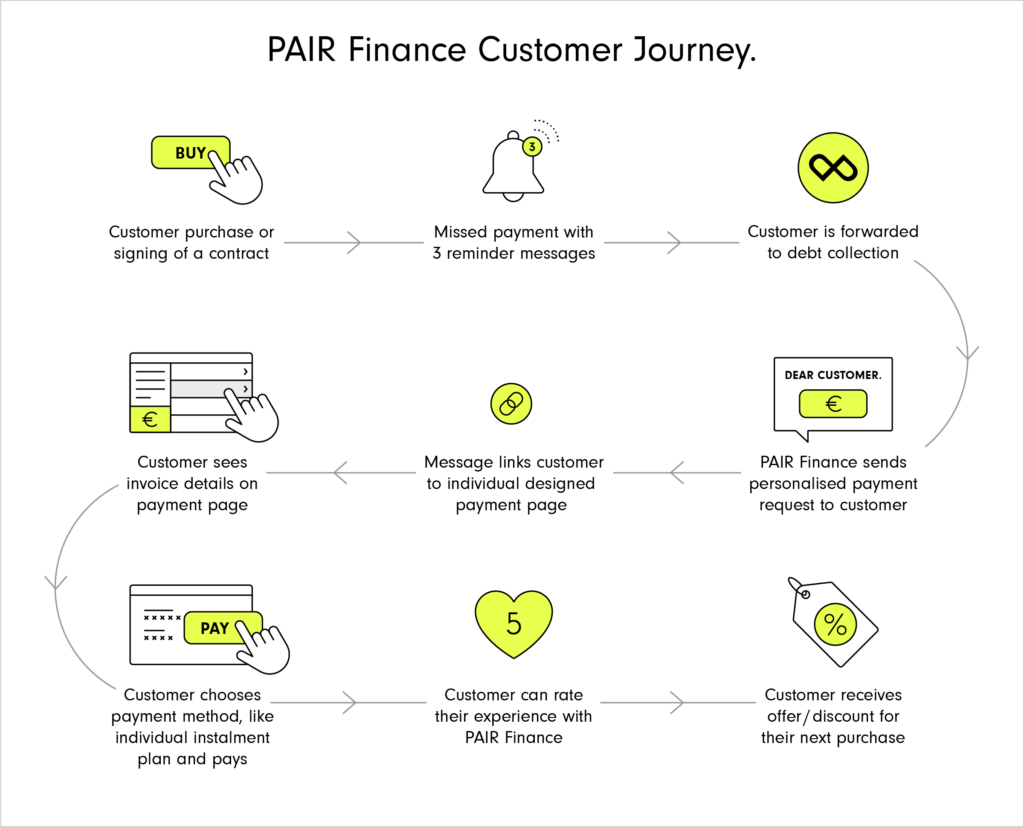

Modern debt collection therefore uses data analysis, machine learning and behavioural psychology to address different debtor groups individually. For example, PAIR Finance differentiates between various debtor types with regard to their willingness to pay, ability to pay, financial organisation and emotional behaviour (more on this in the PAIR Finance customer typology study and below in the article). The goal is always an out-of-court solution in the interest of both, consumers and companies. Artificial intelligence and the associated personalisation make it possible to offer customers what they want and what suits their individual situation. Thus, both factors play a decisive role in a successful debt collection customer experience.

Exceeding customer expectations with 24/7 self-service and smart assistance.

Self-service is becoming increasingly popular with customers (Zendesk). Today’s consumers expect to be able to manage their financial affairs in a self-determined and flexible way on their smartphone at a time of their choosing. The reason for this? On the one hand, they are looking for comfort and convenience: the smartphone is now a ubiquitous companion and allows consumers to manage their finances at any time and from anywhere. This makes the process of managing finances more convenient and comfortable. Physical visits to bank branches or carrying documents around are no longer necessary. But speed and efficiency are also in demand: by using financial apps and mobile banking platforms, consumers can monitor their finances in real time and carry out transactions instantly.

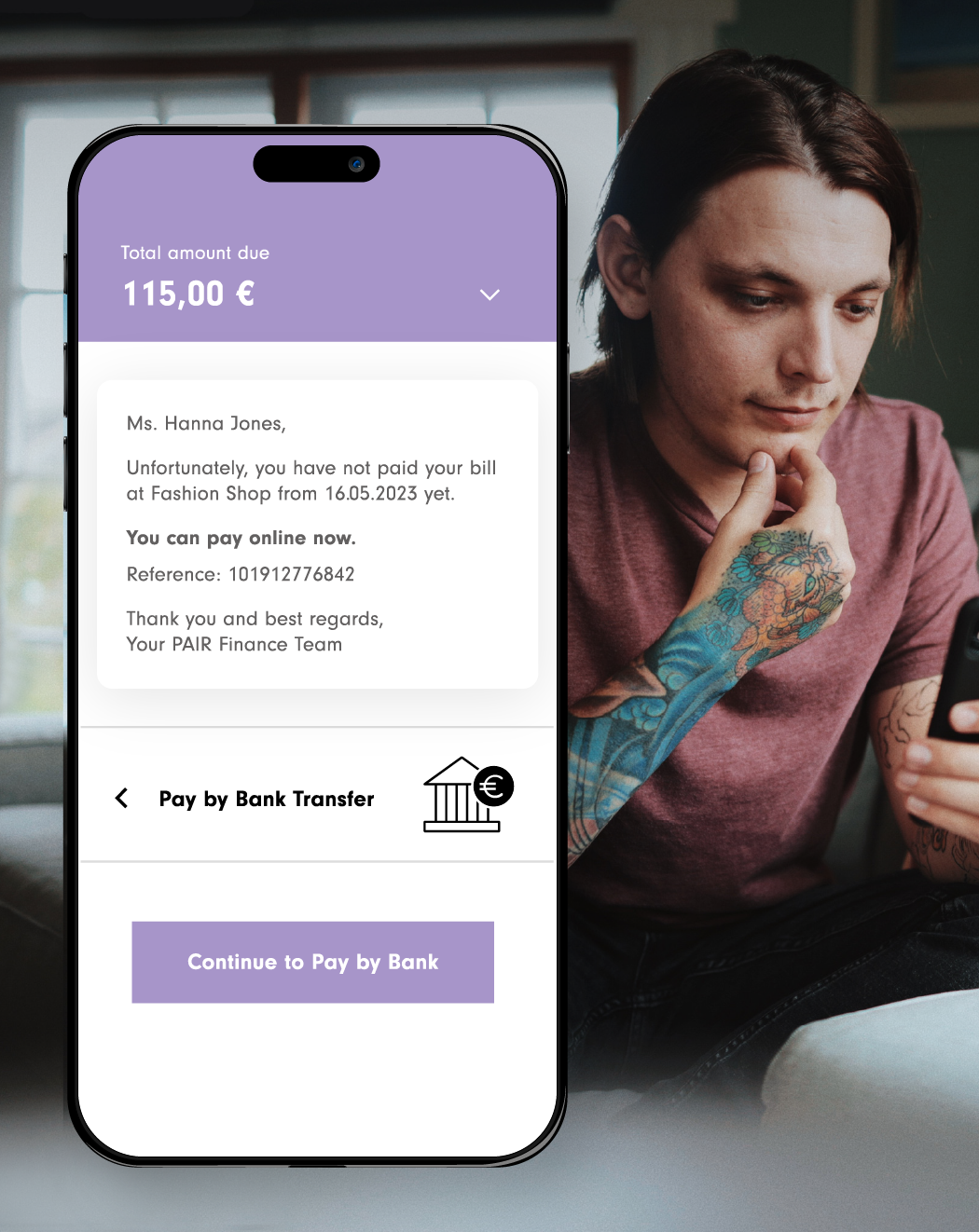

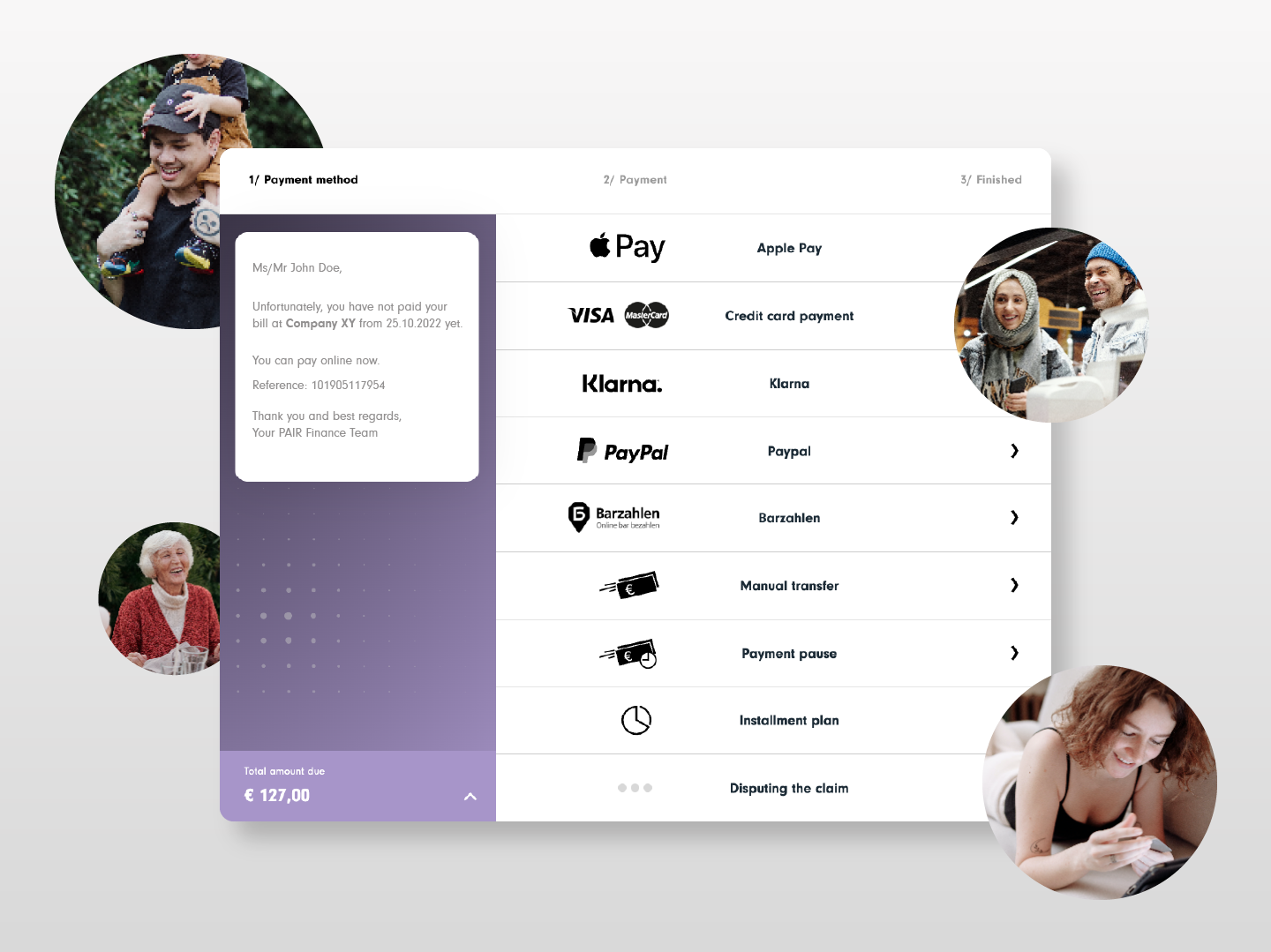

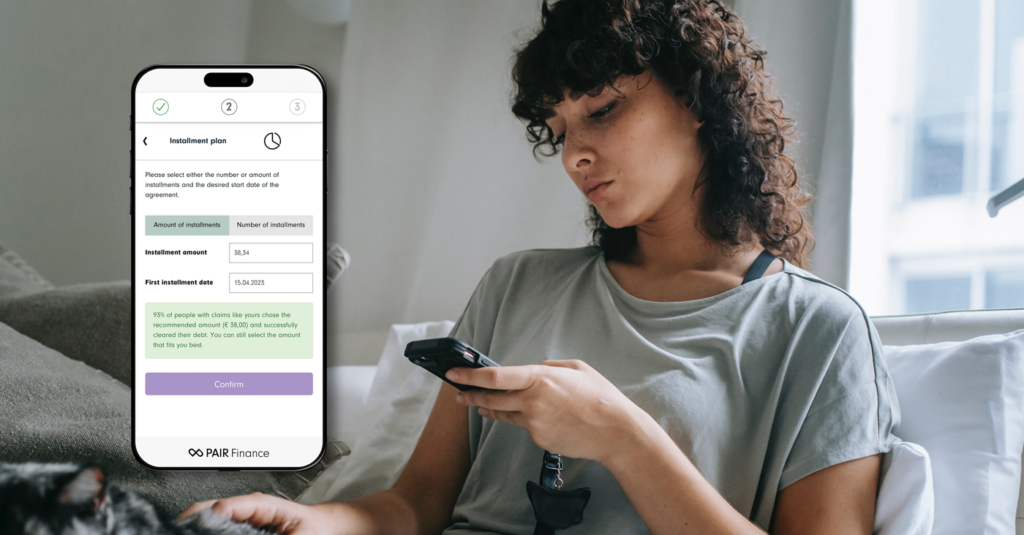

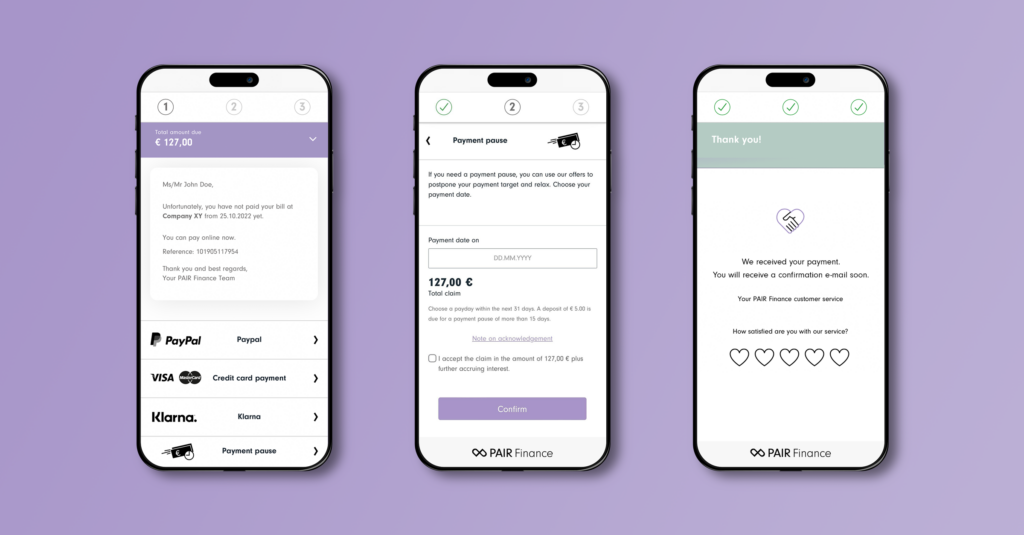

The same demands also apply to the settlement of outstanding debts. Here, too, consumers expect self-service – but what is the best way to implement it? By giving your customers the opportunity to settle their debts in real time, conveniently at any time via smartphone, laptop or tablet. This can be done, for example, with an individual payment link that takes your customers to a payment page with several options. In this way, you enable them to take action when they want to and when they can do so. This increases the chance of a successful repayment of the outstanding amount many times over.

Different payment methods, communication channels, tonalities and timing – this is how personalised debt collection works.

Modern debt collection goes one step further and enables not only self-service, but also customer-friendly, individually tailored collection strategies. Because if the channel, timing, tone, payment methods and the solutions offered are personalised, this can reduce the average days sales outstanding (DSO). In other words, the number of days that pass from the time the invoice is issued until the company receives payment. Artificial intelligence is the key to implementing personalised debt collection professionally.

Channel and tonality

Consumers can no longer do without digital devices, but they are becoming more selective about how they spend their screen time (Global Consumer Trends 2023, Euromonitor). Therefore, not only the appropriate channel mix (email, SMS, Whatsapp…) but also the most promising message should be chosen for the targeted approach. Depending on the type classification, a person receives specific incentives (nudges) in the tonality best suited to their type.

Timing

For example, if someone is mainly active on his or her smartphone in the evening, it is more likely that he or she will notice a payment request via SMS, email or Whatsapp and possibly react directly. The more data we have on consumer behaviour, the more targeted our actions can be. In addition, the choice of the appropriate time also depends on the type of debtor.

Payment method and option

The right choice of payment methods and options can also speed up the process. One third of all consumers say they will abandon the payment process if their preferred payment method is not available (Adesso Digital Commerce Study 2023).

This is how retention succeeds in receivables management.

In most cases, it is cheaper to retain existing customers than to acquire new ones. One way to increase the so-called customer retention rate is to offer rewards in the form of discounts and vouchers. These can also be used successfully in debt collection and receivables management. After all, almost one in three of those surveyed in a study in cooperation with Coupons4U say they will only buy a product if a discount voucher is available. If you offer customers who settle outstanding debt vouchers or discounts at your company, you show that you are still interested in a relationship despite payment problems and make the first step.

The principle of personalisation based on technology also applies here: different customer types react differently to loyalty measures such as vouchers or discounts. It is therefore worthwhile to use artificial intelligence to set an incentive or not, depending on the customer type and strategy. If I, as a customer, am convinced by the product or service and it is communicated to me right from the start that I will receive a voucher if I pay, I have additional motivation to settle the outstanding bill quickly.

Conclusion

The customer journey and the customer experience are of crucial importance for companies, as they have a significant influence on customer loyalty and protect against losing customers. Especially in receivables management, touchpoints arise that can decide whether someone remains a customer or not. An optimal customer journey should therefore include both receivables management and debt collection. This requires technological innovations: Modern debt collection companies use artificial intelligence, data analysis, machine learning and behavioural psychology to address different debtor groups individually and thus achieve an out-of-court solution in the interest of consumers and companies. For a successful debt collection customer experience, your company should offer 24/7 self-service and smart assistance in receivables management. This way you can meet or even exceed the expectations of your customers. By personalising the channel, timing, tone, payment methods and solutions offered, you increase the likelihood of recovering receivables faster. In addition, you can target customer retention with vouchers and discounts for successful payments.