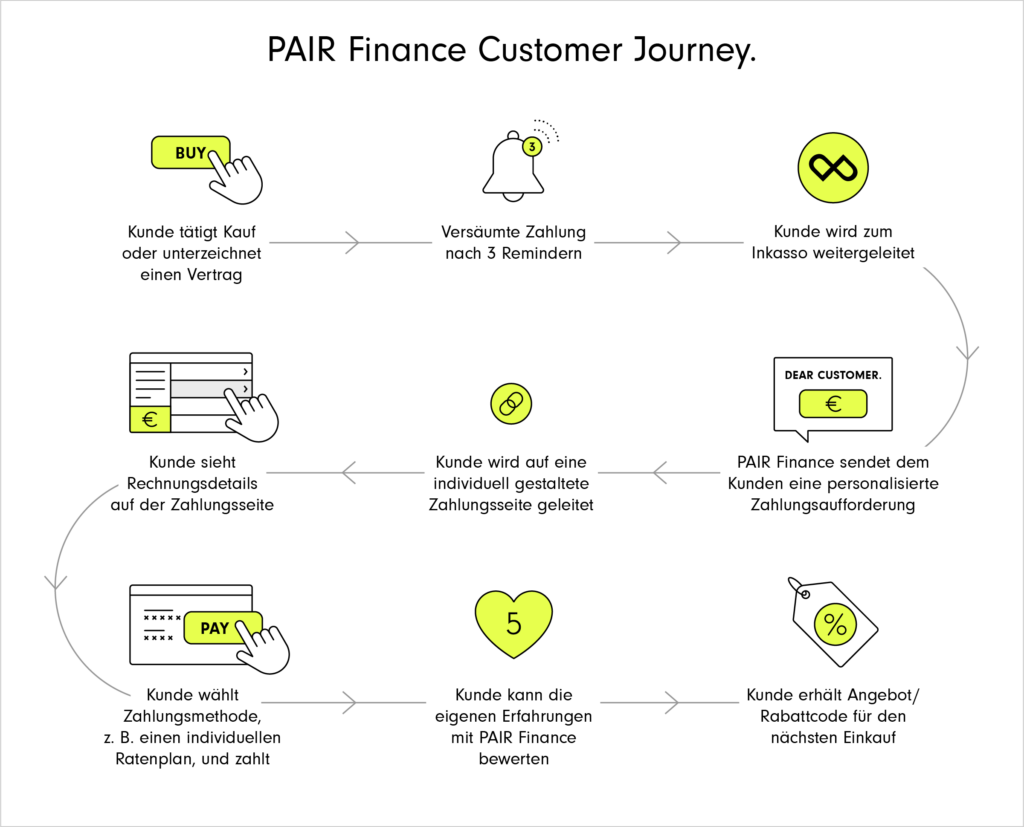

Inkasso kundenorientiert und effizient machen: Wie KI und Personalisierung die Customer Journey verbessern

Wenn Kund*innen nicht bezahlen, kann das unterschiedliche Ursachen haben. Zum Beispiel finanzielle Schwierigkeiten, Unzufriedenheit mit Ware, Dienstleistung oder Vertrag, oder eine vergessene Rechnung. Das ist aber nicht der einzige ausschlaggebende Faktor. Es ist zusätzlich wichtig zu verstehen, dass jeder Mensch, auf der sogenannten Customer Journey, anders reagiert und denkt.

Je besser wir einen Menschen kennen, je mehr Daten und Anhaltspunkte wir zur Verfügung haben, desto spezifischer können wir auf die Person zugehen. Unternehmen sollten daher die Customer Journey und die Customer Experience kontinuierlich analysieren und optimieren, um eine positive Wahrnehmung zu erzielen und langfristige Bindungen aufzubauen. Das gilt auch für Finanzteams, denn im Finance-Prozess finden viele Kundenkontakte statt.

Die Rolle von KI und Personalisierung in der erfolgreichen Inkasso Customer Experience.

Modernes, personalisiertes Inkasso nutzt Datenanalyse, Machine Learning und Verhaltenspsychologie, um verschiedene Verbraucher-Gruppen individuell anzusprechen. PAIR Finance unterscheidet zum Beispiel zwischen vielfältigen Verbraucher-Typen im Hinblick auf ihre Zahlungsbereitschaft, Zahlungsfähigkeit, finanzielle Organisation und ihr emotionales Verhalten (mehr dazu in der PAIR Finance Kundentypologie-Studie und weiter unten im Artikel).

Ziel dabei ist immer eine außergerichtliche Lösung im Sinne von Verbraucher*innen und Unternehmen. Künstliche Intelligenz und die damit verbundene Personalisierung machen es möglich, Kund*innen das zu bieten, was sie sich wünschen und was zu ihrer individuellen Situation passt. Somit spielen beide Faktoren eine maßgebliche Rolle in der erfolgreichen Inkasso Customer Experience.

Mit 24/7 Self Service und smarten Hilfestellungen die Erwartungen der Kundschaft übertreffen.

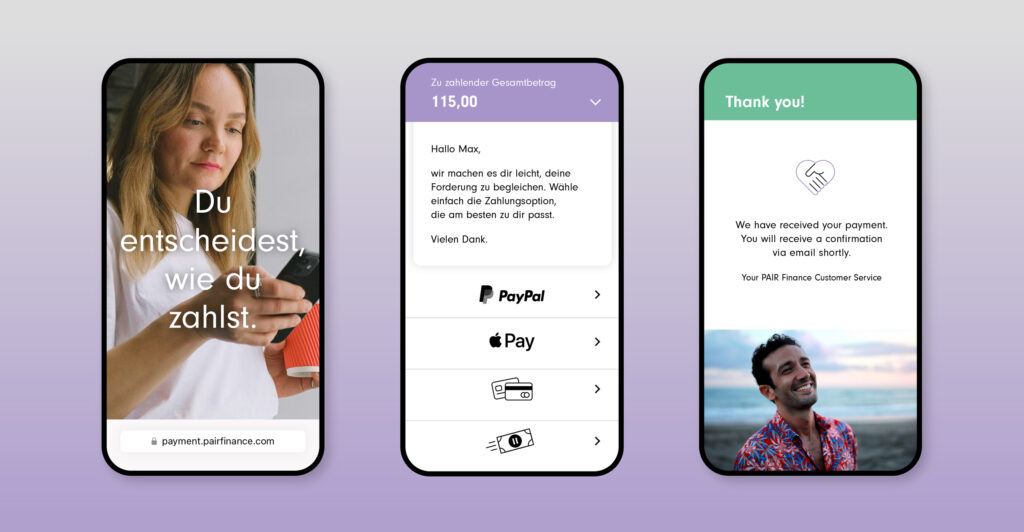

Der sogenannte “Self Service” wird bei Kund*innen immer beliebter (Zendesk). Verbraucher*innen erwarten heutzutage, dass sie ihre finanziellen Angelegenheiten selbstbestimmt und flexibel zur selbst gewählten Zeit auf dem Smartphone erledigen können. Der Grund dafür? Auf der einen Seite suchen sie Komfort und Bequemlichkeit: Das Smartphone ist heutzutage ein allgegenwärtiger Begleiter und ermöglicht es den Verbraucher*innen, ihre Finanzen jederzeit und von überall aus zu verwalten.

Dadurch wird der Prozess der Finanzverwaltung bequemer und komfortabler. Denn physische Besuche in Bankfilialen oder das Herumtragen von Dokumenten sind nicht mehr notwendig. Aber auch Schnelligkeit und Effizienz sind gefragt: Durch die Verwendung von Finanz-Apps und mobilen Banking-Plattformen können Verbraucher*innen ihre Finanzen in Echtzeit überwachen und Transaktionen sofort durchführen.

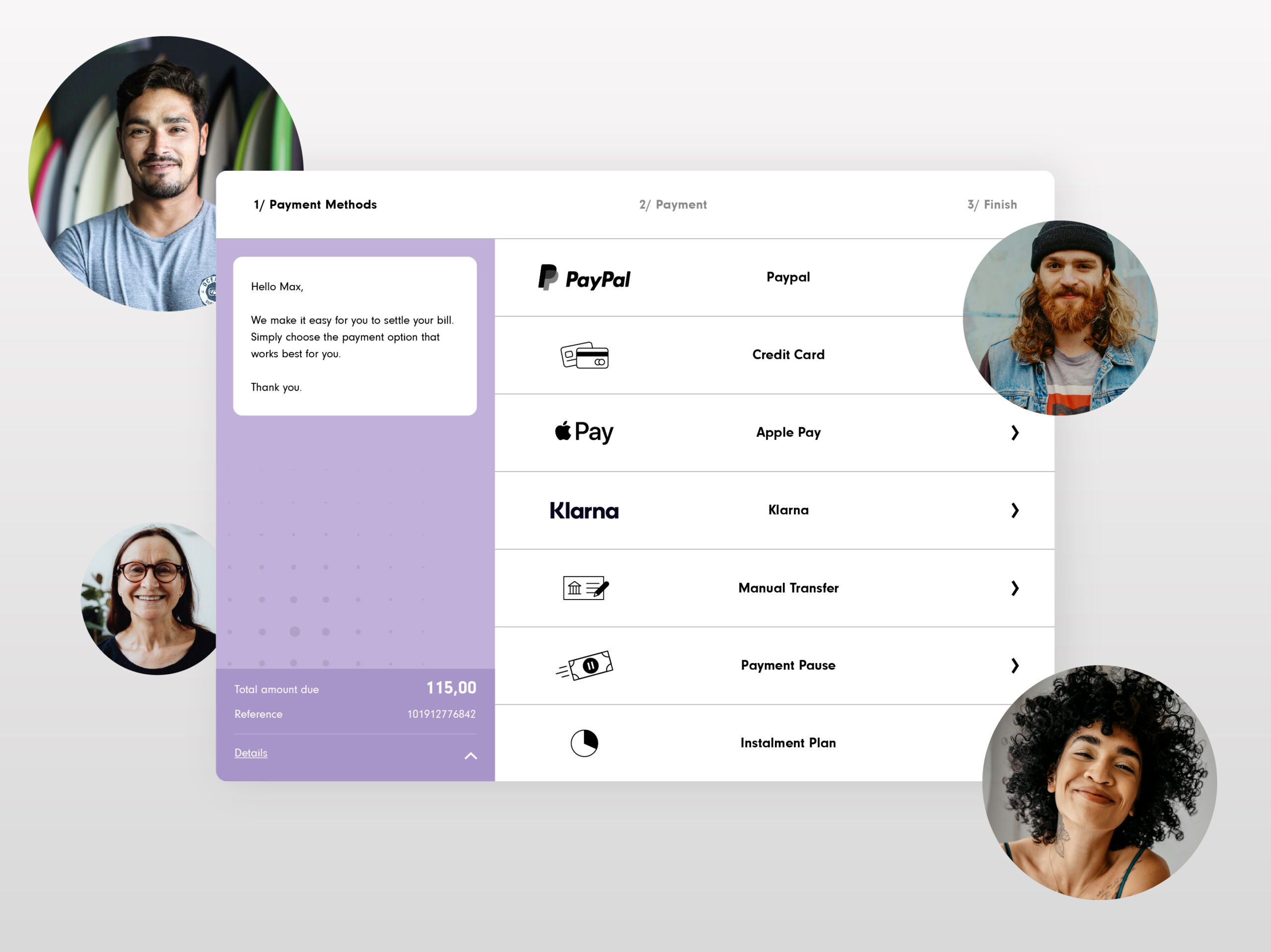

Dieselben Ansprüche bestehen auch beim Begleichen offener Forderungen. Auch hier erwarten Verbraucher*innen Self Service – nur, wie lässt sich dieser am besten umsetzen? Indem du deinen Kund*innen die Möglichkeit gibst, ihre offenen Beträge in Echtzeit bequem jederzeit via Smartphone, Laptop oder Tablet zu begleichen.

Das geht zum Beispiel mit einem individuellen Payment Link, über den deine Kund*innen auf eine Bezahlseite mit mehreren Optionen gelangen. So befähigst du sie, dann tätig zu werden, wenn sie es wollen und können. Damit erhöht sich die Chance auf eine erfolgreiche Rückzahlung des offenen Betrags um ein Vielfaches.

Unterschiedliche Zahlungsmethoden, Kommunikationskanäle, Tonalitäten und Zeitpunkte – so funktioniert personalisiertes Inkasso mit KI.

Modernes Inkasso geht noch einen Schritt weiter und ermöglicht nicht nur Self Service, sondern auch kundenfreundliche, individuell zugeschnittene Inkassostrategien. Denn wenn Kanal, Zeitpunkt, Tonalität, Zahlungsmethoden und die angebotenen Lösungen personalisiert sind, kann das die durchschnittliche Außenstandsdauer der Forderungen (Days Sales Outstanding, DSO) reduzieren. Also die Anzahl von Tagen, die vom Zeitpunkt der Rechnungsstellung bis zum Zahlungseingang beim Unternehmen vergehen. Künstliche Intelligenz ist der Schlüssel, um personalisiertes Inkasso professionell umzusetzen.

Kanal und Tonalität

Verbraucher*innen kommen nicht mehr ohne digitale Endgeräte aus, werden allerdings wählerischer dabei, wie sie ihre Bildschirmzeit verbringen (Global Consumer Trends 2023, Euromonitor). Daher sollte für die gezielte Ansprache nicht nur der passende Kanal-Mix (Mail, SMS, Whatsapp…), sondern auch die erfolgversprechendste Nachricht gewählt werden. Je nach Typ-Zuordnung erhält eine Person spezifische Anreize (Nudges) in der zu ihrem Typ am besten passenden Tonalität.

Zeitpunkt

Ist jemand zum Beispiel vorwiegend abends auf dem Smartphone aktiv, dann ist es wahrscheinlicher, dass sie oder er genau dann eine Zahlungsaufforderung per SMS, E-Mail oder Whatsapp bemerkt und eventuell direkt reagiert. Je mehr Daten zum Verbraucherverhalten vorliegen, desto gezielter kann hier agiert werden. Zusätzlich hängt die Wahl der passenden Uhrzeit aber auch damit zusammen, welcher Verbraucher-Typ jemand ist.

Zahlungsart und -option

Auch die richtige Auswahl der angebotenen Zahlungsmittel und -optionen kann den Prozess beschleunigen. Ein Drittel aller Verbraucher*innen gibt an, den Zahlungsvorgang abzubrechen, wenn ihre bevorzugte Zahlungsart nicht vorhanden ist (Adesso Digital Commerce Studie 2023).

So gelingt Retention im Forderungsmanagement.

Bestandskund*innen zu halten ist in den meisten Fällen günstiger, als Neukund*innen zu akquirieren. Eine Möglichkeit, die sogenannte Customer Retention Rate, also die Kundenbindungsrate, zu steigern, sind Belohnungen in Form von Rabatten und Gutscheinen. Diese lassen sich auch im Inkasso und im Forderungsmanagement erfolgreich einsetzen.

Immerhin kauft fast jeder Dritte der Befragten einer Studie in Kooperation mit Coupons4U nur dann ein Produkt, wenn ein Rabattgutschein zur Verfügung steht. Wenn du Kund*innen, die eine offene Forderung begleichen, Gutscheine oder Rabatte bei deinem Unternehmen anbietest, zeigst du, dass du trotz Zahlungsstörung weiterhin an einer Beziehung interessiert bist und machst den ersten Schritt.

Auch hier greift das Prinzip der Personalisierung basierend auf Technik: verschiedene Kundentypen reagieren unterschiedlich auf Treuemaßnahmen wie Gutscheine oder Rabatte. Es lohnt sich deshalb, mit Hilfe von Künstlicher Intelligenz je nach Kundentyp und Strategie ein Incentive zu setzen oder nicht. Wenn ich als Kund*in vom Produkt oder Service überzeugt bin, und mir direkt von Beginn an kommuniziert wird, dass ich einen Gutschein erhalte, wenn ich bezahle, habe ich eine zusätzliche Motivation, die offene Rechnung zügig zu begleichen.

Künstliche Intelligenz revolutioniert das Inkasso: Personalisierte Lösungen steigern Kundenbindung und Zahlungserfolg

Die Customer Journey und die Customer Experience sind von entscheidender Bedeutung für Unternehmen, da sie maßgeblich die Kundenbindung beeinflussen und davor schützen, Kund*innen zu verlieren. Insbesondere im Forderungsmanagement entstehen Berührungspunkte, die darüber entscheiden können, ob jemand Kund*in bleibt, oder nicht. Eine optimale Customer Journey sollte deshalb sowohl Forderungsmanagement als auch Inkasso einschließen.

Dazu bedarf es technologischer Innovationen: Moderne Inkassounternehmen nutzen Künstliche Intelligenz, Datenanalyse, Machine Learning und Verhaltenspsychologie, um verschiedene Verbraucher-Gruppen individuell anzusprechen und somit eine außergerichtliche Lösung im Sinne von Verbraucherinnen und Unternehmen zu erreichen. Für eine erfolgreiche Inkasso Customer Experience sollte dein Unternehmen 24/7 Self Service und smarte Hilfestellungen im Forderungsmanagement anbieten.

So kannst du die Erwartungen deiner Kund*innen zu erfüllen oder gar übertreffen. Wenn du den Kanal, den Zeitpunkt, die Tonalität, die Zahlungsmethoden und die angebotenen Lösungen personalisierst, erhöhst du die Wahrscheinlichkeit, Forderungen schneller zurückzuführen. Darüber hinaus kannst du mit Gutscheinen und Rabatten bei erfolgreicher Zahlung gezielt die Customer Retention steigern.