One year at PAIR Finance: COO Sven Schneider on disruption, growth and the future of debt collection

A year ago, we succeeded in recruiting the experienced debt collection and finance expert Sven Schneider from a traditional debt collection company for PAIR Finance, where he took on the key role of COO. The move not only marked a new career step, but also opened up the opportunity to play a major role in the success of a disruptive innovation leader in digital debt collection. In this interview, he talks about what motivated him to make this change, how PAIR Finance stands out from the traditional debt collection business and which technological innovations particularly impress him. He looks back at key milestones and provides an exciting insight into what is yet to come.

Sven, in 2023 you left your career at a traditional debt collection company to join PAIR Finance. What made you do it?

After almost 20 years in debt management, including more than 10 years in management positions, I felt it was time for a change of perspective. As managing director of the German debt collection unit of a corporation, I realised several years ago that the company needed to change to avoid being disrupted by innovators like PAIR Finance. After two major transformation projects, most recently at European level, I was tempted by the opportunity to switch to a ‘disruptor’.

Which aspects of PAIR Finance appealed to you most?

PAIR Finance, although already established as a leading digital debt collection company, is in an entirely different stage of development. Here, it’s not about transformation but about driving robust international growth and building the necessary structures to support it. Especially exciting is the unified software platform, designed from the outset with machine learning in mind, which shows market leading results and continuously offers tremendous potential.

I was also impressed by the management team and the corporate culture of PAIR Finance. This is a place where we can implement things quickly and ‘hands-on’ and also take risks that often involve lengthy discussions in a larger corporate structure. It is precisely this dynamism and agility that I was looking for.

With your experience in the industry: What makes PAIR Finance different from conventional debt collection companies and makes the company an innovation leader in debt collection?

PAIR Finance stands out from other debt collection companies in a number of key ways. One key aspect is our one-platform approach. We work with a single, cloud-based platform that is used in all countries. Traditional providers often have to deal with fragmented and decentralised systems that limit their ability to innovate and the quality of their service. From the outset, our platform has been designed to allow us to roll out new features quickly and efficiently on a global basis.

Another factor which sets PAIR Finance apart is our advanced, fully integrated AI. Our AI is based on a holistic approach and uses reinforcement learning to continuously optimise decisions across the entire platform. Unlike many competitors who only use the technology in certain areas, our AI is deeply integrated into all processes and learns from every single piece of feedback.

How does this approach affect consumer communication?

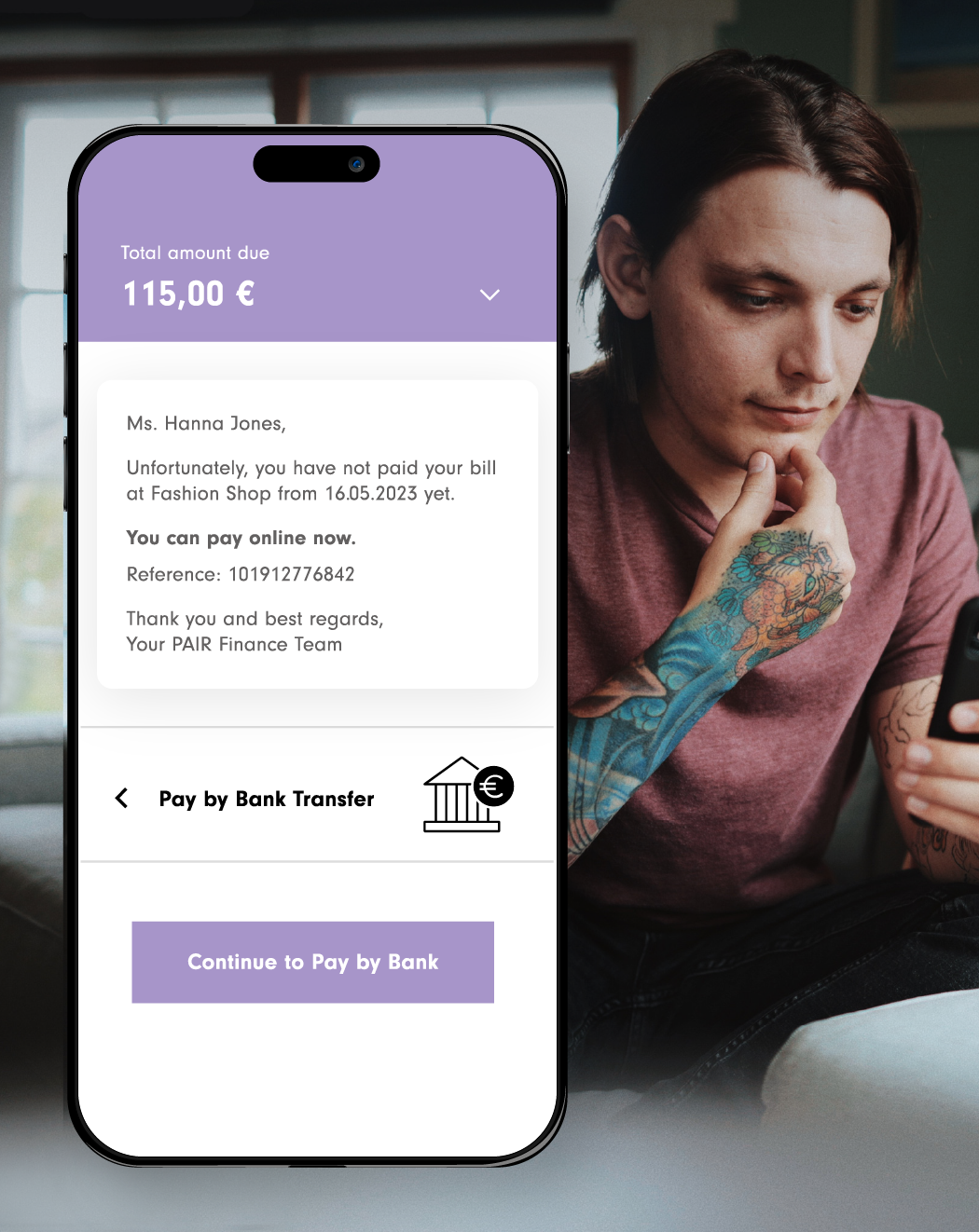

This approach also allows PAIR Finance to set new standards in the area of personalised communication. Our AI manages several dimensions of communication at the same time – from channel and timing, to frequency and tonality, to the solution offered. This allows us to develop highly individualised, behaviourally psychological, communication strategies that are precisely tailored to the needs of consumers. This goes far beyond what is common in the industry. Another key advantage is the scalability of this personalised communication across all countries.

Another area in which PAIR Finance is a leader is intelligent customer experience management and automation of support in our contact centre. Using generative AI (GenAI) and our LLM (Large Language Model), which has been specially developed for the debt collection sector, we can automatically identify and individually process more than 90% of customer concerns. Currently, 30% of our processes are fully automated, and we expect to increase this to over 50% by the end of the year. This efficiency leads to better consumer care and is ultimately reflected in higher customer satisfaction.

Why should business customers who already know you now choose PAIR Finance?

Business customers who know me are aware that, as well as efficiency, I also prioritise fair and personal treatment of consumers. The aim is to simplify the relationship between our business customers and their consumers. Particularly when things get difficult in the customer relationship, I want to provide a pleasant experience, so consumers happily remain customers.

At the same time, it is important to me to offer appropriate solutions to consumers who have run into financial difficulties. The reasons for missing payments are as varied as people’s life situations. That is why we focus on a simple, understandable and personalised approach. It’s about creating transparency, building trust and offering suitable payment options so that we can find a solution together.

What advantages does PAIR Finance offer here?

Our combination of AI and behavioural science allows us to approach consumers with outstanding debts in a targeted and individual way – an example of our strong consumer focus, which is also reflected in our many positive Trustpilot reviews. For our business clients, this means that we achieve individual solutions and optimum recoveries, and at a consistently high level across countries.

On the subject of values: What role do you think they play?

I believe that shared, actively practised values are crucial in shaping a company’s culture and ultimately ensuring long-term success. They are the difference between a mediocre and a great company. Our values, such as innovation, customer focus, and execution strength, form the DNA of PAIR Finance. Especially as a company grows, it’s vital to nurture, pass on, and be held accountable to these values to ensure they don’t get diluted.

What mission is PAIR Finance pursuing with its values?

Our mission is to use artificial intelligence and behavioural research to settle outstanding claims without damaging the relationship between business customers and consumers. Despite the difficult starting position, the debt collection process should be a positive experience for consumers. That is why we focus on consumers as individuals and offer understanding, tailored solutions. These values guide our actions and ensure that we see the person behind the debt.

What have been the most exciting developments and personal highlights of your first year at PAIR Finance, both on a technological and strategic level?

My first year at PAIR Finance was characterised by a lot of exciting developments. The expansion to Spain and Sweden were particularly impressive. Both projects were characterised by strong execution and it was really impressive how quickly these launches could be realised. The launch in Sweden, in particular, required some local adjustments and agile project management. The expansion in Austria, Switzerland and the Netherlands also brought us further strategically.

A personal highlight was the success of our measures to increase customer satisfaction, as reflected in our excellent Trustpilot score. This is a major challenge in our industry, but it shows that our approach of creating a positive customer experience, even in difficult situations, works.

Looking to the future, what issues do you think will be the focus for PAIR Finance in the next year?

Of course, we don’t want to give away all our secrets just yet – after all, our planning meeting for 2025 is still to come. But the core topics I am focusing on will remain basically the same. We will continue to work on increasing efficiency and maximising returns. In addition, further international expansion will continue, and we will focus on further establishing the newly acquired markets such as Spain and Sweden. Another focus is on broadening our industry expertise. I am particularly looking forward to the imminent launch of some new key accounts. Of course, customer satisfaction also remains a key concern – we will continue to pursue this vigorously.

What developments do you expect in the field of technology?

In terms of technology, one focus will be on expanding our intelligent customer experience management with the help of generative AI. This is where we are taking the next step in automation and will expand the approach to other channels such as voice. But our focus extends well beyond the trendy topic of GenAI. Since PAIR Finance was founded, artificial intelligence has been at the heart of product development – an approach that has made the company the technology leader in the debt collection industry. We want to further strengthen this advantage and take the performance of our systems to a new level.

In the next few years, I see PAIR Finance as one of the leading debt collection companies in Europe, convincing business customers and consumers alike with technological excellence and smart solutions.

_____________

Ready to change the financial world with us?

Do you want to work with Sven on the future of the financial world? Then we would love to meet you. You can find our current job offers here.