Customer Experience.

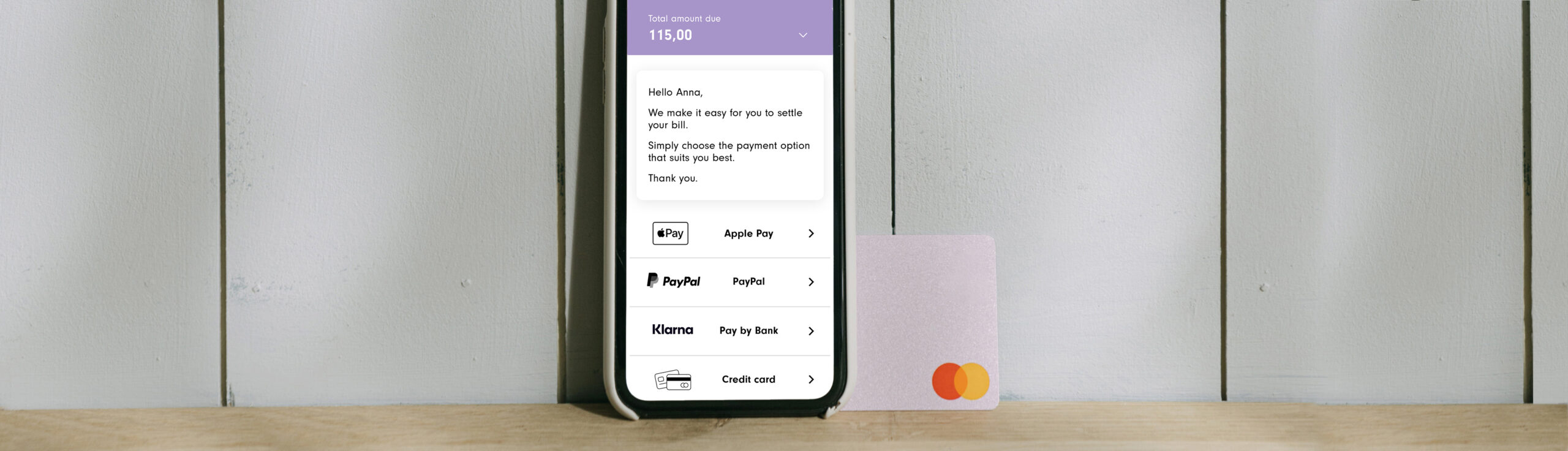

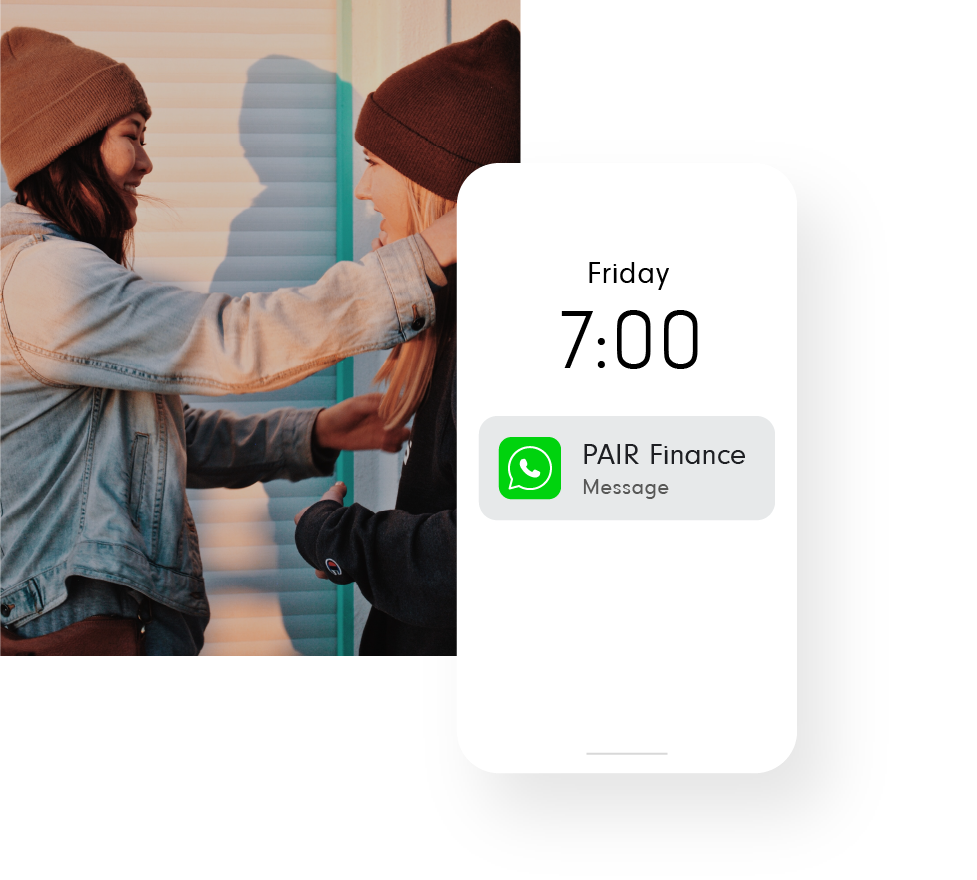

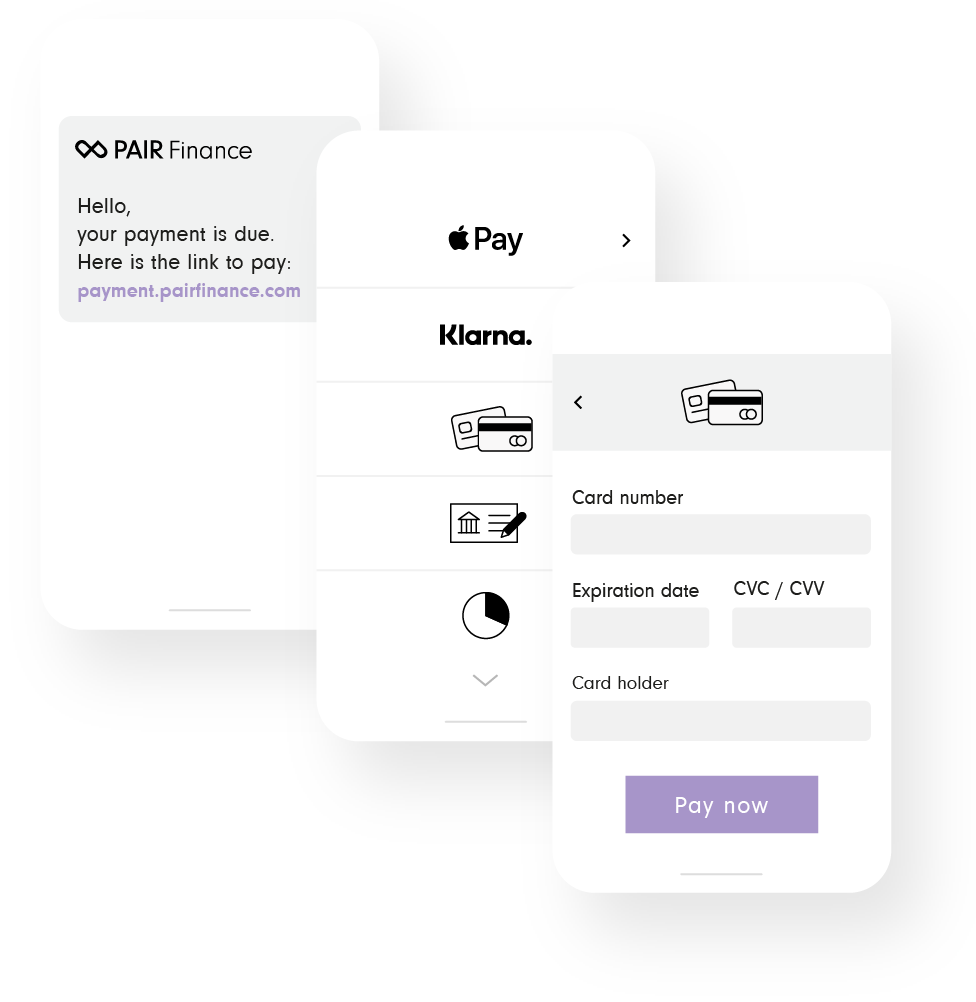

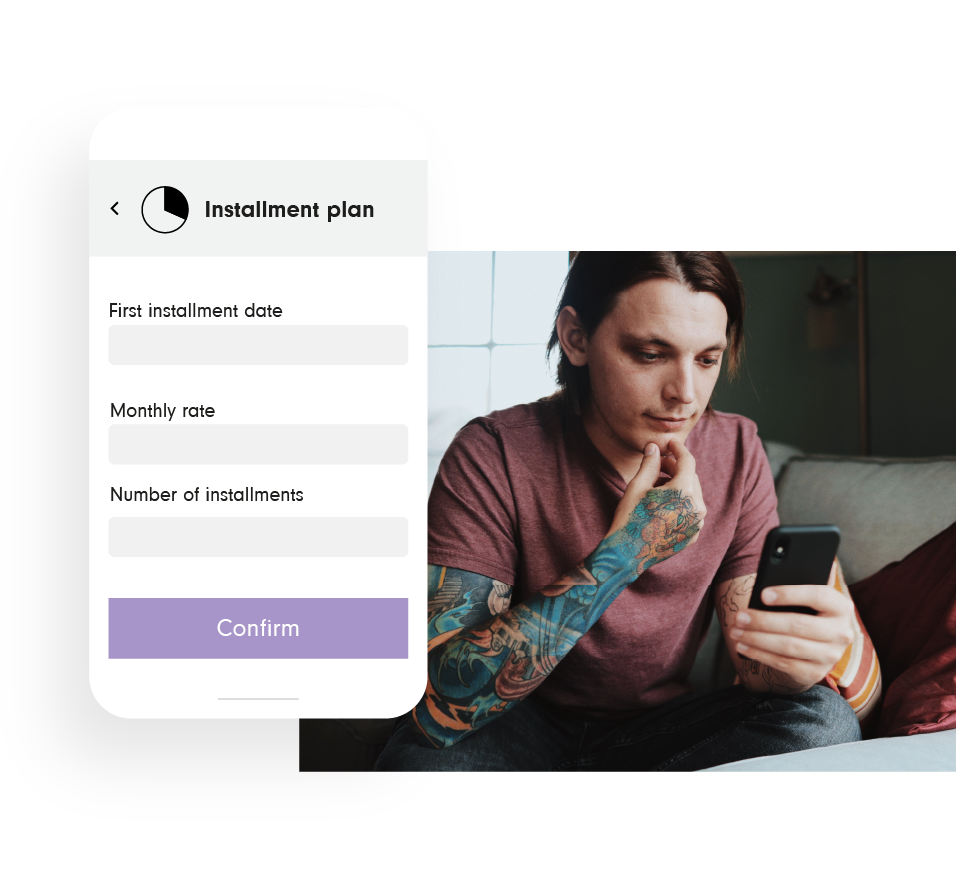

Say good-bye to traditional hassles of debt collection. We ensure a new experience that empowers your customers to effortlessly manage and resolve debts, putting them back in control of their financial freedom.

Debt collection process.

We carry out the entire debt collection process for our clients:

From extrajudicial dunning procedures to further escalation stages.

Depending on the country in which we operate, the components of the process may vary.

1. Pre court procedures

2. Court procedures

3. After court procedures

4. Monitoring