Spain.

Financial centres, fashion retail, start-ups and culture – PAIR Finance has been launched in Spain in 2024. The country is known as a pioneer in digitalisation. Here, the fintech is meeting the growing demand for efficient and digital debt collection.

Our debt collection process.

We carry out the entire collection process for our clients: From extrajudicial dunning procedures to further escalation steps. Depending on the country in which we operate, the components of the process may vary.

Our industries.

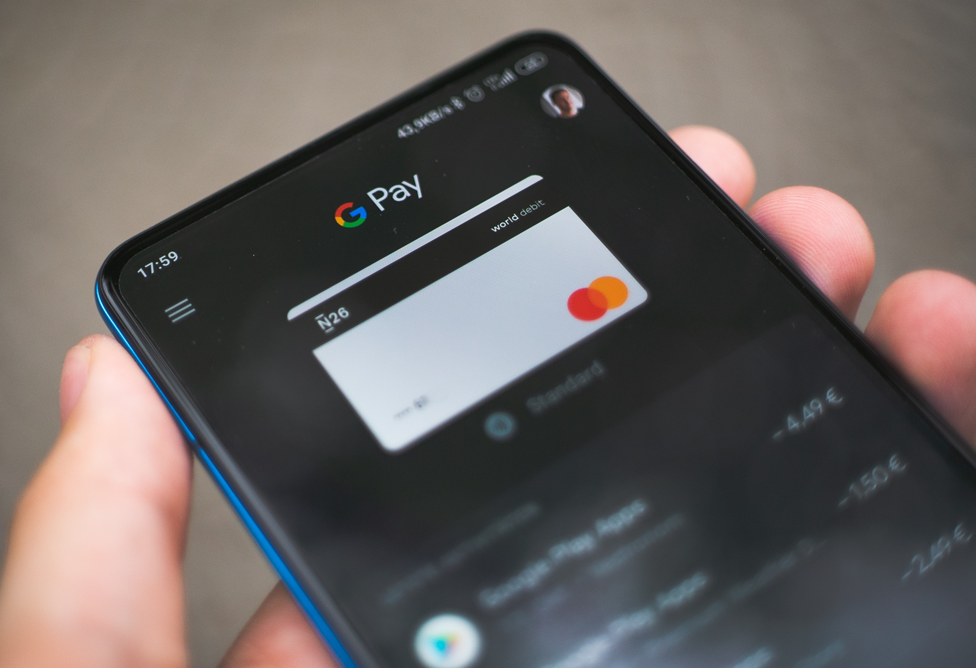

Convenient payment methods are essential in e-commerce, but online retailers sometimes take enormous risks with them. We always tailor our AI-based debt collection to individual needs and thus help our e-commerce clients to deal with missed payments efficiently and sustainably.

In the payment sector, the focus is particularly on the end customer. PAIR Finance uses targeted measures in the collection process that both secure the payment provider's liquidity and maintain the relationship with the end customer. In this way, we offer online payment providers efficient and innovative receivables management.

One of the main challenges of receivables management for mobility operators is the fact that they very often deal with very small receivables. In addition, secure customer retention is one of the crucial variables for business success. Our digital, efficient process starts exactly there.

When it comes to insurance receivables, speed is particularly important. PAIR Finance enables insurers and insurtechs to repay outstanding claims quickly and easily and advises them on how to increase their recovery and maintain their corporate reputation.

Particularly in the case of utility companies, we often observe a tendency to quickly initiate court dunning proceedings, which does not do justice to a customer-oriented approach. PAIR Finance relies on a dynamic and intensive pre-court reminder process and tries to maintain your customer relationship despite debt collection.

Receivables management in the digital age must be kept efficient and simple, particularly for companies that offer online services. Especially in the digital world, there is a growing desire for customers to remain customers after the payment problem has been resolved.

High costs in the area of customer acquisition put pressure on margins, especially for banks and fintechs. For this reason, customer-oriented receivables management and a modern, digital solution are essential.

Regardless of whether you are a network operator or a service provider, we will find the right channel for communicating with your customers, regardless of the degree of digitalisation of our clients. Especially when a channel is already closed.