Financial resolutions 2022: 2 out of 3 Germans want to optimize their finances

Berlin, January 17, 2022 – Save more money, consume less, and invest money: That’s what many people are resolving to do in 2022. A representative Civey survey of 2,501 people in Germany commissioned by PAIR Finance and Fabit shows what resolutions Germans have regarding their private finances for 2022. A decision psychologist helps with practical tips on how to implement these plans.

One in three wants to save more money in 2022

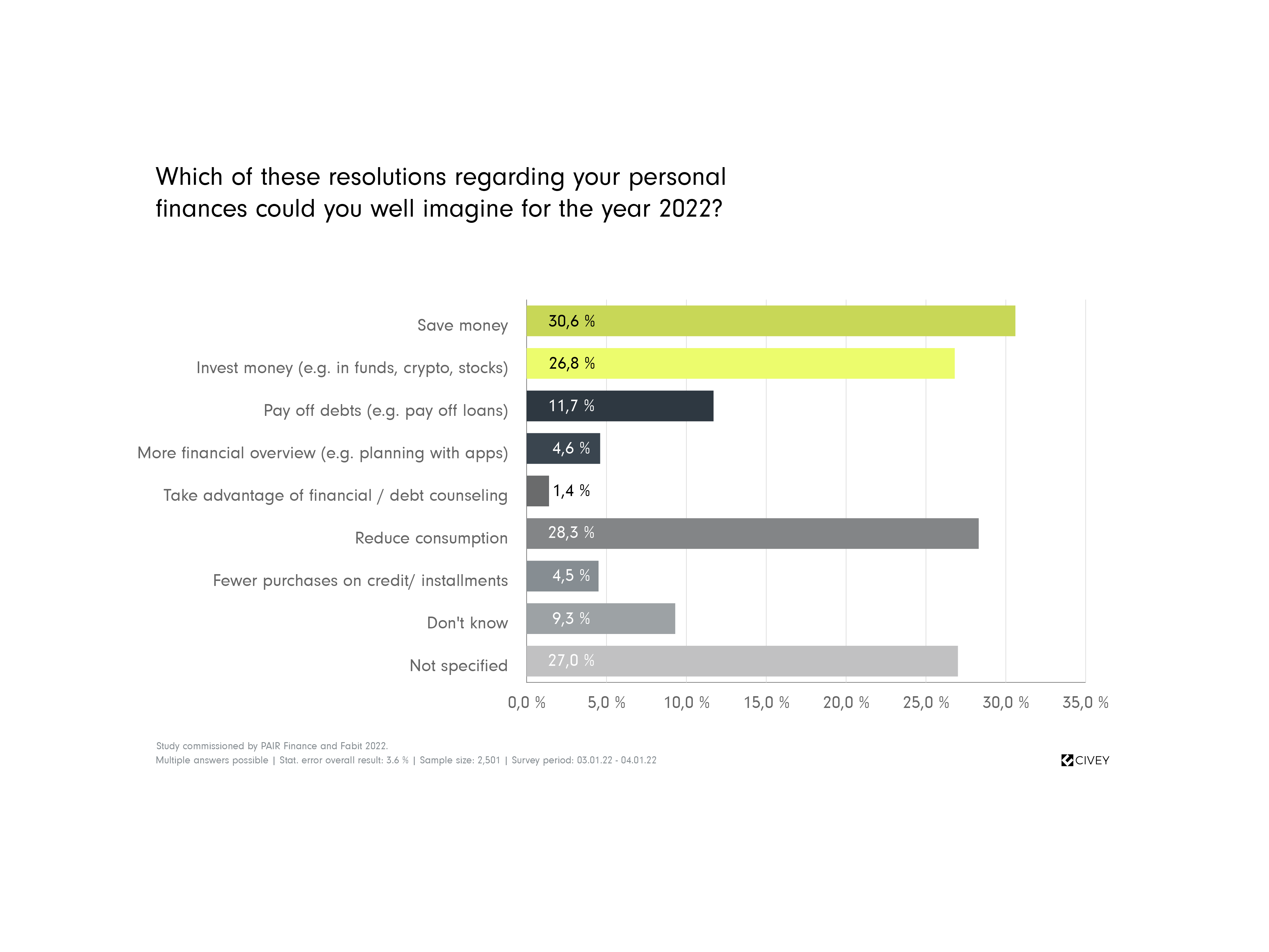

Almost two-thirds (62.7 percent) of Germans have resolved to actively reshape the way they handle money in 2022. Many want to either save more money (30.6 percent), reduce their own consumption (28.3 percent) or invest money in funds, cryptocurrencies or shares (26.8 percent). One in ten (11.7 percent) has resolved to pay off debts and loans. More overview of their own finances with the help of apps was the goal of 4.6 percent of respondents. The situation is similar for purchases on installments and credit: 4.5 percent want to do this less in 2022. Only 1.4 percent of Germans consider it important to seek financial and debt advice.

| Save money | 30,6 % |

| Reduce consumption | 28,3 % |

| Invest money (e.g. in funds, crypto, stocks). | 26,8 % |

| Pay off debts (e.g. pay off loans) | 11,7 % |

| More financial overview (e.g. planning with apps) | 4,6 % |

| Fewer purchases on credit/in installments | 4,5 % |

| Take advantage of financial / debt counseling | 1,4 % |

| I don‘t know | 9,3 % |

| No data | 27,0 % |

Question: Which of these resolutions regarding your private finances could you well imagine for the year 2022?, multiple answers possible, survey period: 03.01.-04.01.2022, total participants: 2,501, representative of German citizens aged 18 and over, stat. Error: 3.6 %.

“The results of our joint survey with PAIR Finance on financial resolutions show that personal finances and one’s spending habits play an essential role for the majority of Germans in the new year,” Susanne Krehl, founder of Fabit, comments on the results. Fabit has made it its goal to empower people to better manage their own money and optimize their financial habits.“

Stephan Stricker, Founder and CEO PAIR Finance, said, “In recent years, many people have been caught off guard by financial difficulties during the pandemic or rising inflation. The number of consumer bankruptcies more than tripled within one year. With this study, we show how Germans plan to prepare themselves in money matters this year.” With AI-based digital debt collection, PAIR Finance creates personalized solutions for people in arrears.

Young people want to save more

There are major differences in financial intentions, particularly in the various age groups and in terms of gender. While one in two out of 18- to 29-year-olds wants to save more money, only 26.5 percent of 50- to 64-year-olds wants to do so. The ratio is also evident when it comes to investing money: While more than half of the respondents aged up to 29 (50.9 percent) want to invest money in the stock market, only 19.9 percent of the 50- to 64-year-olds have set their sights on doing so. When it comes to reducing consumption, the willingness to do so decreases with age: while one in three (34.2 percent) of those under 39 want to consume less in 2022, only one in four of those aged 40 and over will do so (40-49: 24.6 percent; 50-64: 28.2 percent; 65 and over: 26.6 percent).

| 18-29 years | 30-39 years | 40-49 years | 50-64 years | 65 years + | |

| Save money | 50,0 % | 36,7 % | 38,6 % | 26,5 % | 24,1 % |

| Reduce consumption | 34,2 % | 34,2 % | 24,6 % | 28,2 % | 26,6 % |

| Invest money (e.g. in funds, crypto, stocks). | 50,9 % | 42,5 % | 33,5 % | 19,9 % | 18,5 % |

| Pay off debts (e.g. pay off loans) | 5,0 % | 14,8 % | 19,2 % | 13,9 % | 6,3 % |

| More financial overview (e.g. planning with apps) | 10,4 % | 2,9 % | 8,7 % | 4,1 % | 2,6 % |

| Fewer purchases on credit/in installments | 9,6 % | 2,9 % | 5,0 % | 4,5 % | 4,0 % |

| Take advantage of financial / debt counseling | 4,5 % | 3,5 % | 0,0 % | 1,1 % | 0,7 % |

| I don‘t know | 0,0 % | 3,8 % | 9,9 % | 12,0 % | 10,9 % |

| No data | 22,0 % | 20,1 % | 16,5 % | 27,5 % | 35,3 % |

Question: Which of these resolutions regarding your private finances could you well imagine for the year 2022?, multiple answers possible, survey period: 03.01.-04.01.2022, total participants: 2,501, representative of German citizens aged 18 and over, stat. Error: 3.6 %.

Twice as many men as women want to invest their money in 2022

The differences between the sexes can be seen above all in the “save money” and “invest money” plans. While one in three men surveyed wants to put more money aside, the figure for women is only 27.2 percent. The difference is even more extreme when it comes to investing money: 35.2 percent of men have this plan, but only 17.3 percent of women.

| Woman | Man | |

| Save money | 27,2 % | 33,6 % |

| Reduce consumption | 28,4 % | 28,3 % |

| Invest money (e.g. in funds, crypto, stocks). | 17,3 % | 35,2 % |

| Pay off debts (e.g. pay off loans) | 9,7 % | 13,5 % |

| More financial overview (e.g. planning with apps) | 2,8 % | 6,1 % |

| Fewer purchases on credit/in installments | 3,7 % | 5,3 % |

| Take advantage of financial / debt counseling | 0,6 % | 2,1 % |

| I don‘t know | 9,6 % | 9,1 % |

| No data | 33,1 % | 21,5 % |

Question: Which of these resolutions regarding your private finances could you well imagine for the year 2022?, multiple answers possible, survey period: 03.01.-04.01.2022, total participants: 2,501, representative of German citizens aged 18 and over, stat. Error overall result: 3.6.

4 tips to successfully implement financial resolutions

Decision psychologist Dr. Minou Goetze knows why we have such a hard time with resolutions. She teaches at the Fresenius University of Applied Sciences in Hamburg, is a former PAIR Finance employee and continues to support Digitalinkasso with behavioral psychology issues. “When keeping resolutions, the conflict between an immediate reward (e.g. buying expensive shoes) and an even better future reward (money saved) plays an important role. The immediate reward is tempting and can only be postponed through self-control. How good people are at resisting this temptation can be predicted, for example, by their personality traits and brain activity,” Goetze said.

“With enough self-discipline, financial resolutions made become habits over time that help people become financially healthy in the long run,” Krehl adds. “However, mustering enough self-control is only possible if the motivation is right. That’s why Fabit actively accompanies its users in their everyday lives. More than 100 challenges help users question old habits and improve their own behavior.”

But how can you deal with your financial resolutions more confidently? The psychologist has a few practical tips for this.

1. Set concrete goals instead of making resolutions.

Resolutions are usually formulated in a general and unspecific way. For example, ‘I want to lose some weight,’ or ‘I want to spend less money.’ But these are not goals. “Goals should always be specific, measurable, attractive, realistic and timed,” Goetze explains. Applied to finances, it then means: ‘I want to save at least 50 euros every month in order to have saved 600 euros by the end of the year.’

2. Exploit avoidance of losses.

It is known from behavioral research that people want to avoid (financial) losses at all costs. This knowledge can be used by committing to pay a certain amount if one does not achieve one’s goal. In the best case, the amount would benefit an institution that one explicitly does not want to support (e.g. tobacco industry).

3. Track progress

The more transparent you are about whether and how much you are approaching your goal, the more likely you are to actually achieve it. In addition, it motivates you to be able to observe changes. Apps such as Fabit can help with this.

4. Talk about resolutions and goals

You want to keep your good resolutions to yourself so that no one notices what you have resolved to do? Susanne Krehl of Fabit knows that’s not a good idea: “When we’re up to something difficult and trying to change our habits, it’s good to be able to talk about this change process. Positive social pressure helps to persevere.” Friends and family can provide additional motivation through praise and positive feedback.

About PAIR Finance

PAIR Finance is the leading fintech for debt collection and receivables management in Germany. The company is transforming the debt collection industry by making receivables management sustainable, digital, efficient and customer centric. With the help of Artificial Intelligence, Behavioral Analytics and Data Science, PAIR Finance recovers lost revenue from unpaid invoices. More than 350 companies from a wide range of industries are already working successfully with the collection solution for the digital age, including Zalando, Klarna, Home24 and Sixt. The fast-growing company, which was founded in Berlin in 2016, has around 160 experienced employees at its corporate locations in Berlin and Vienna and is led by founder and CEO Stephan Stricker.

About Fabit

Fabit is an app for optimizing financial habits. It is aimed at people who want to manage their finances better in order to lead a financially healthy and relaxed life in the long term. “Fabit” is derived from the English “Financial Habit” – financial habit. Fabit GmbH, the company behind Fabit, was founded in Berlin in 2021 by Dr. Ralf-Michael Schmidt, Robert Heim and Susanne Krehl.

Press contacts

PAIR Finance:

Denise Schoenherr

Mobil: +49 (0) 179 9101120

E-Mail: media@pairfinance.com

Fabit:

Julia Ptock

Mobil: +49 (0) 176 637 419 85

E-Mail: presse@fabit.app