The internationally leading fintech for AI-based debt collection, PAIR Finance, is unveiling its payment platform with a completely new design and an exciting new feature that grants users access to exclusive offers.

Consumer expectations are constantly evolving. Leading online retailers set the standard for a new mobile-first customer experience in debt collection by leveraging the potential of brilliant smartphone displays and cutting-edge technology.

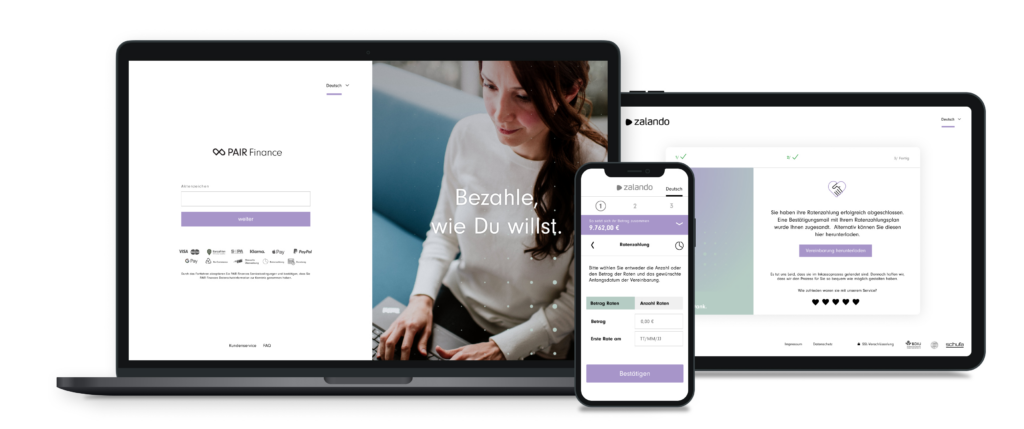

Mobile first: The optimised payment assistant for mobile users

PAIR Finance’s payment platform has seen a steady increase in mobile access. Globally, mobile app usage surged—especially during the COVID-19 pandemic, with a 25% rise in e-commerce usage [Source 1]. Mobile is now the primary choice for PAIR Finance users, with around 60% of consumers settling their outstanding debts using mobile devices.

The newly redesigned payment platform has been developed as a personal, mobile-optimised payment assistant that fits right in your pocket. It serves as the central touchpoint for consumers looking to settle outstanding payments digitally with PAIR Finance. Mobile access is set to continue growing: 92% of Germans now own a smartphone [Source 2], and even among the 65+ generation, nine out of ten respondents in a Deloitte 2024 survey reported owning one.

Clear design and emotional colour palette – enhancing customer satisfaction in debt collection

The platform’s clean, functional design, combined with emotional colour accents and a user-friendly typography, sets a deliberate contrast to traditional payment communication. As seen on PAIR Finance’s corporate website, purple and jade green dominate the visual identity of user communication.

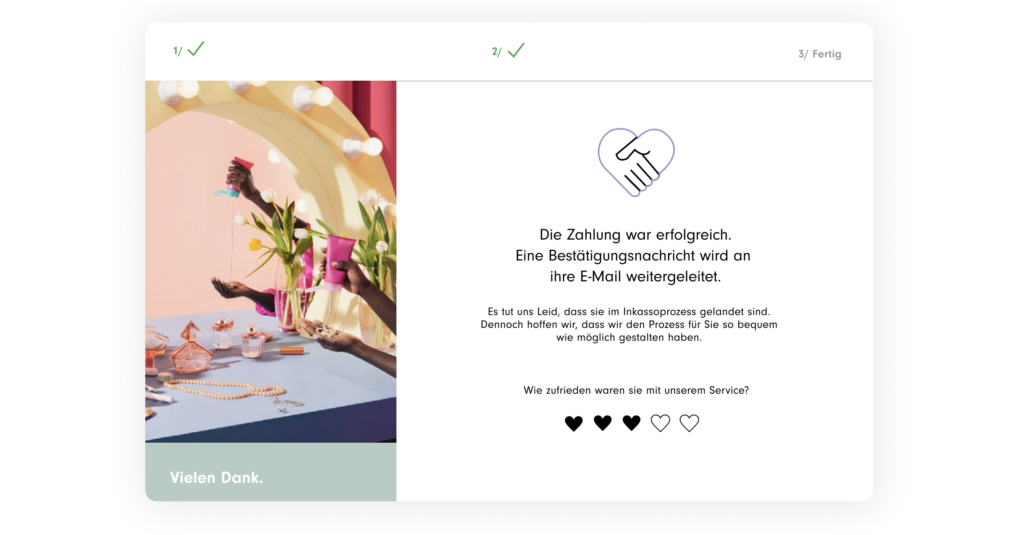

Key design highlights include the animated login page at payment.pairfinance.com, which welcomes users with changing visuals and offers a selection of eight languages, the customisable “thank you” page, and the new retention-focused section. Users can access the platform in German, English, French, Spanish, Italian, Dutch, Turkish, and Portuguese.

Our goal: We want to help people to manage their finances confidently with their smartphone.

Stephan Stricker, Founder and CEO PAIR Finance

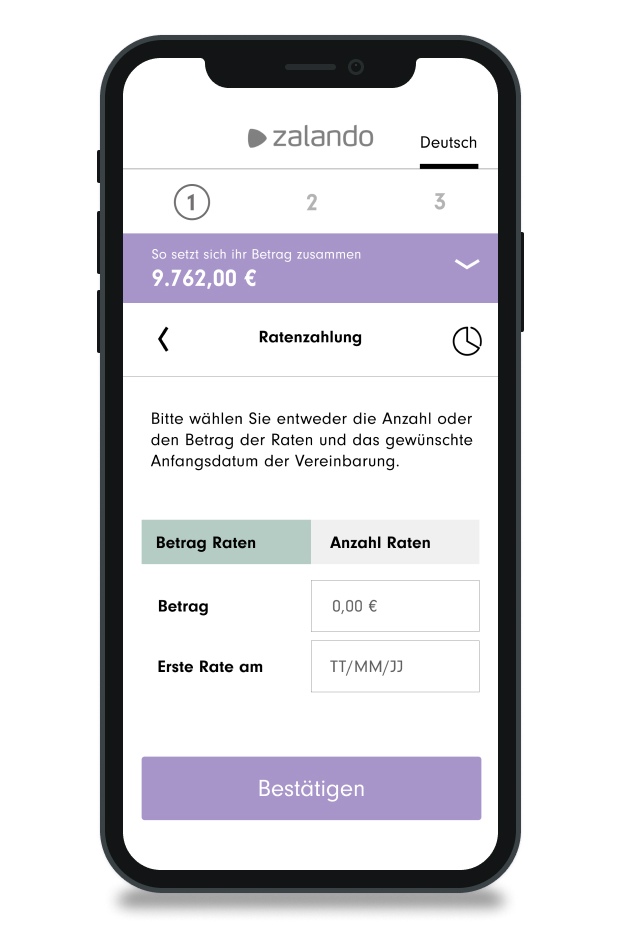

Settle payments in less than a minute

Outstanding debts can be settled on the PAIR Finance platform in just a few clicks and in under a minute, regardless of the payment method chosen. The platform offers a wide variety of payment options, including credit card payments, bank transfers, cash payments, payment pauses, Apple Pay, and more.

A standout innovation is the new digital instalment payment feature, allowing consumers to set up their instalment plans digitally and pay individual instalments on the go using the split payments function—a first in debt collection.

New features to boost customer retention in debt collection

PAIR Finance is dedicated to delivering a positive customer experience in debt collection. Since its inception, the fintech has harnessed artificial intelligence and personalisation to enhance the customer journey. Moving forward, PAIR Finance will increasingly support customer retention, a key marketing goal for its corporate clients, as acquiring new customers is significantly more challenging and resource-intensive.

The revamped payment platform introduces an exciting element of interactive customer engagement and retention. Businesses can integrate discount codes to thank customers for their payment or encourage future engagement, such as repeat purchases, contract renewals, or rentals. After completing a payment, users can redeem these codes for their next purchase. The platform also allows for app downloads and personalised content or campaigns. This feature will be fully rolled out in the coming months.

Confidently managing personal finances

“Our corporate customers like Zalando, Klarna or Sixt are experiencing a rapid increase in customer expectations. They attach considerable importance to inspiring the consumer throughout the entire customer journey”, says Stephan Stricker, founder and CEO of PAIR Finance. “We are therefore excited to create the next level of digital payment experience in debt collection with the new payment site that will make a real difference to consumers. Our goal is to help people manage their finances faster and more confidently. That’s why we are now bringing even more user-friendliness and attractiveness to payment processes.”

With the design overhaul, fonts, colour schemes, and subtly updated logo developed during the PAIR Finance branding process have now been integrated into the payment process. The visual identity of the payment platform payment.pairfinance.com clearly reflects its connection to the PAIR Finance brand.

Looking for a partner to implement customer-friendly debt collection digitally, easily, and successfully?

Find out what PAIR Finance can achieve for you.

Sources:

https://onlinemarketing.de/mobile-marketing/e-commerce-apps-lockdown-weltweit-25-prozent-gestiegen

Last updated: 20 January 2025, by Jana Caterina Erhardt