PAIR Finance is the new cooperation partner of the VR Smart Guide, the digital financial planning and invoicing solution from VR Smart Finanz AG, which belongs to the DZ BANK Group. In addition to functionalities for order management and tax preparation, users will in future also benefit from direct access to digital debt collection.

Active receivables management is particularly important for small and medium-sized companies. Because if payments from customers or partner companies fail, this can have a negative impact on the business relationship, lead to a liquidity bottleneck and, in the worst case, threaten the existence of the company. PAIR Finance offers an innovative approach here: With artificial intelligence and customer focus, the fintech improves the payment experience and ensures more customer loyalty – thanks to the new cooperation, users of the VR Smart Guide are now also benefiting from this.

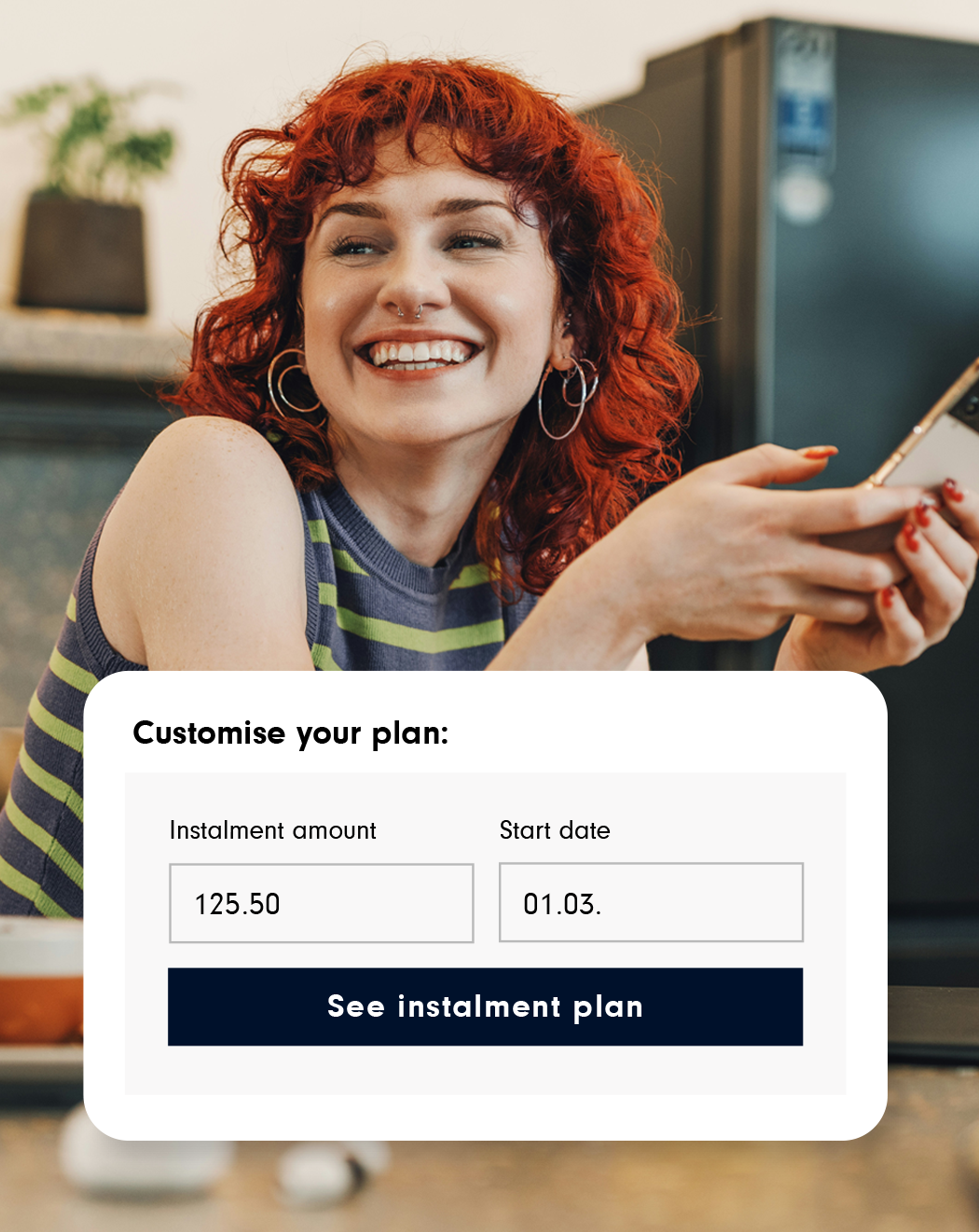

With the VR Smart Guide, the digital financial planning and accounting solution for the self-employed and small businesses, users can digitally manage their invoices, send payment reminders and prepare for taxes. From now on, you also have the option of getting quick support from PAIR Finance with receivables management: As soon as there is at least one outstanding payment reminder, the VR Smart Guide offers its users to contact PAIR Finance directly.

The collaboration is based on the mission of both companies to support self-employed individuals and small businesses with suitable solutions in their everyday financial lives and to drive forward their digitalization.

With this partnership, we are very pleased to provide our business customers with another tool to successfully manage their business in an increasingly digitalized world.

Christian Hammamy, Head of VR Smart Guide

The integration demonstrates the strategic importance of the digital debt collection topic for business and confirms our successful model. Together we will redefine the debt collection experience also in the SME segment for clients and their customers.

Stephan Stricker, Founder and CEO of PAIR Finance

Active receivables management is particularly important for small and medium-sized enterprises. After all, if payments from customers or partner companies are missed, this can have a negative impact on the business relationship, lead to a liquidity bottleneck and, in the worst case, threaten the existence of the company. This is where PAIR Finance offers an innovative approach: with artificial intelligence and customer focus, the fintech improves the payment experience and ensures greater customer loyalty.

Here’s what businesses can do in the event of a missed payment:

- The first step should be to send a payment reminder to the defaulting consumers. This often ensures that the outstanding amount is paid promptly.

- If no payment is made after repeated reminders? Then it is worthwhile not to wait too long with further receivables management.

Click here for the VR Smart Guide:

www.vr-smart-guide.de/forderungsmanagement