PAIR Finance brings digital first debt collection to Poland and opens office in Warsaw

- Michał Gębała appointed Managing Director as part of the Polish expansion strategy of the PAIR Finance Group

- PAIR Finance opens office and builds team in Warsaw

- Innovative technology combines AI, digital communication and behavioural psychology

Warsaw/Berlin, 4 June 2025 – Most people have a negative association with debt collection. PAIR Finance is out to change that. The technology company is using artificial intelligence to do so and is already successfully leading the industry in nine European countries, with customers such as online fashion retailer Zalando. Today, PAIR Finance is announcing its market entry in Central and Eastern Europe with the launch in Poland, marking its tenth market. As part of this step, it is strengthening its management team with Michał Gębała. As Managing Director, he will drive the growth of PAIR Finance in Poland from the Warsaw office together with his team.

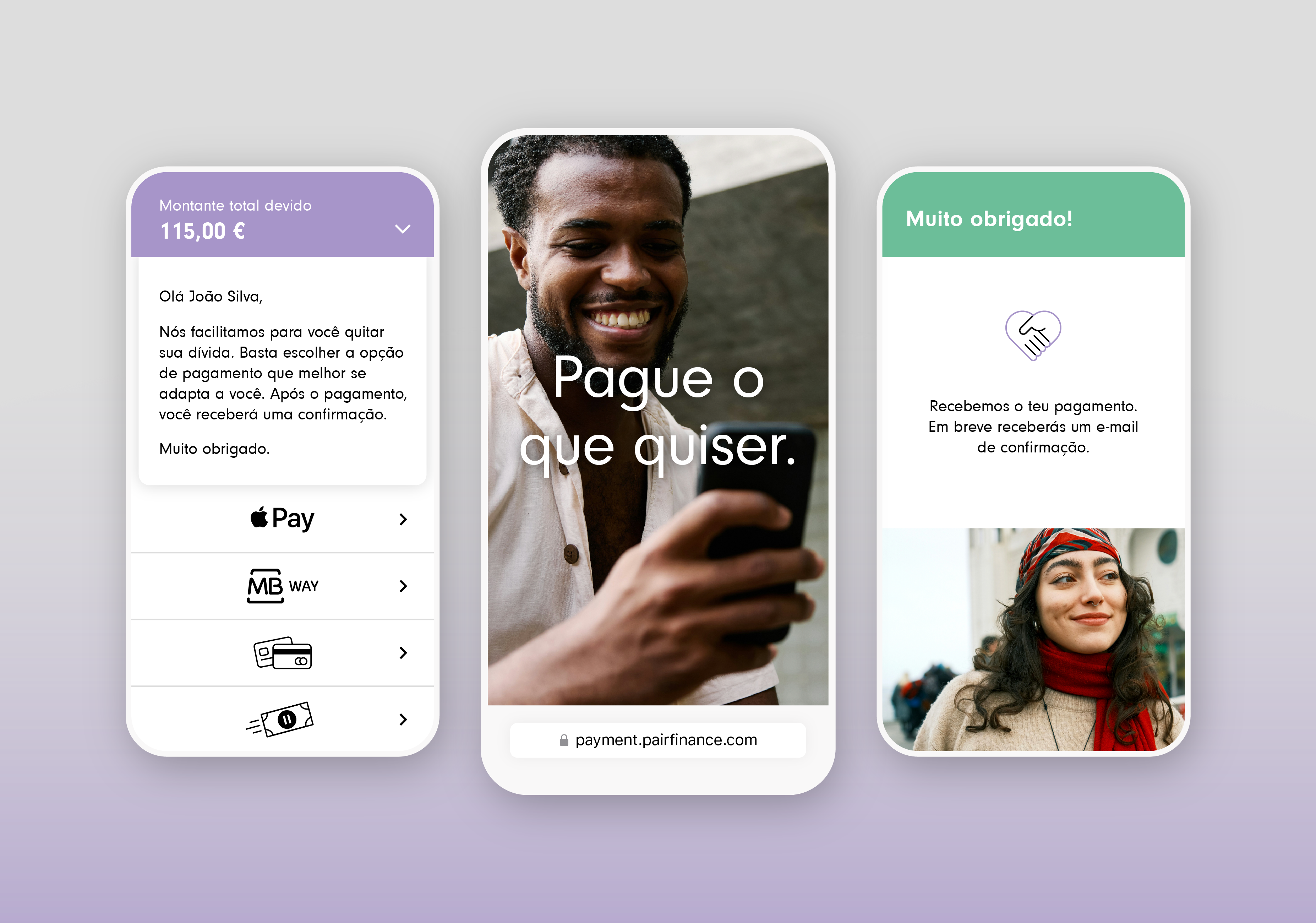

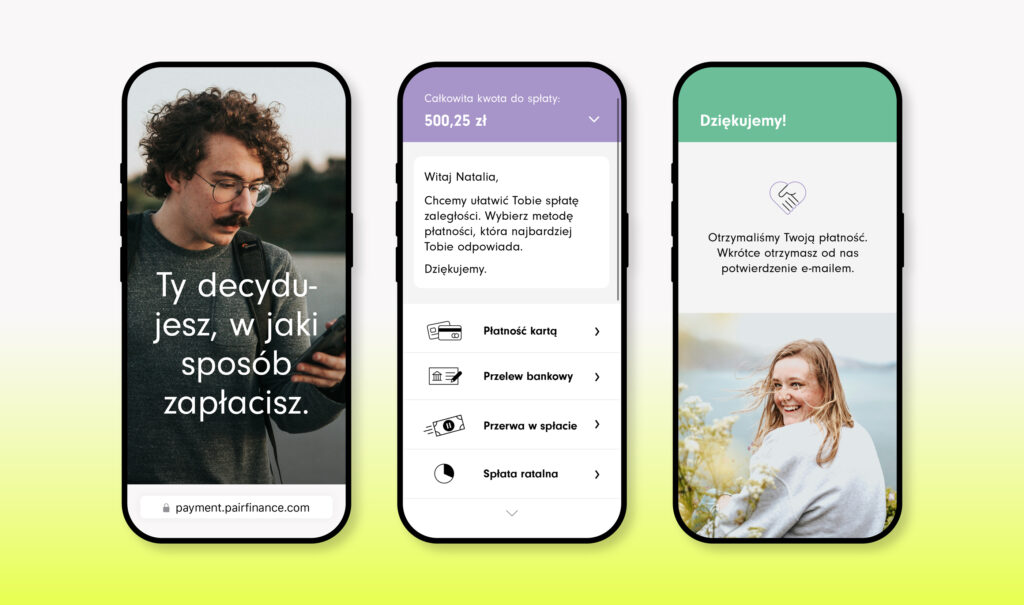

The fintech uses reinforcement learning, supervised learning and GenAI to improve the quality of service in debt collection for consumers and to maximise the recovery rate for business customers. PAIR Finance integrates the latest findings from behavioural economics and psychology. The key to success: individually optimised solutions. For example, the AI model can suggest sending a consumer a message in a cooperative tone on Tuesday noon and offering the payment options BLIK and Apple Pay.

Michał Gębała has been appointed as managing director of PAIR Finance Poland. He has almost two decades of management experience in the financial services industry. Among other roles, Michał Gębała has been Country Head Poland at OMNIO, MyBucks and MiniCredit. His most recent role was Head of Digital Collections at Austrian debt collection company AxFina Holding SA.

‘We are delighted to have won an experienced finance expert like Michał Gębała for PAIR Finance’, says Stephan Stricker, CEO and founder of the PAIR Finance Group. ‘He will be contributing his extensive expertise in Poland to our organisation and has an excellent network. His track record matches our vision of redefining debt collection through bold innovation. With Michał, PAIR Finance is perfectly placed for expansion on the Polish market.’

‘I am excited to be building the Polish market for the most dynamic debt collection tech company in Europe’, says Michał Gębała, Managing Director PAIR Finance Poland. ‘Having seen what the PAIR Finance team has developed and achieved, I am sure that we are ideally positioned to provide Polish companies with a service that is totally new to the market and will lead our industry with our innovative and consumer-centric approach.’

PAIR Finance is attracting strong interest in the European market and, thanks to its outstanding service, has more than 500 business customers, including well-known digital players from sectors such as e-commerce, PSP, banking, digital goods, insurance, TelCo, mobility or energy. A holistic approach helps consumers to make outstanding payments in a self-determined way and avoid legal proceedings. In Poland, the fintech offers consumers popular local payment methods.

Poland is one of the fastest growing economies in Europe. The GDP is expected to rise by 3.5% in 2025. The country currently has a lower debt ratio than the EU average. Household debt in Poland was 23.4% of GDP in the second quarter of 2024, well below the highs of 2015.

Images for editorial use can be found at:

https://pairfinance.com/en/mediakit-poland/