One in three Poles contacted by debt collection: Email and BLIK preferred, PAIR Finance study finds

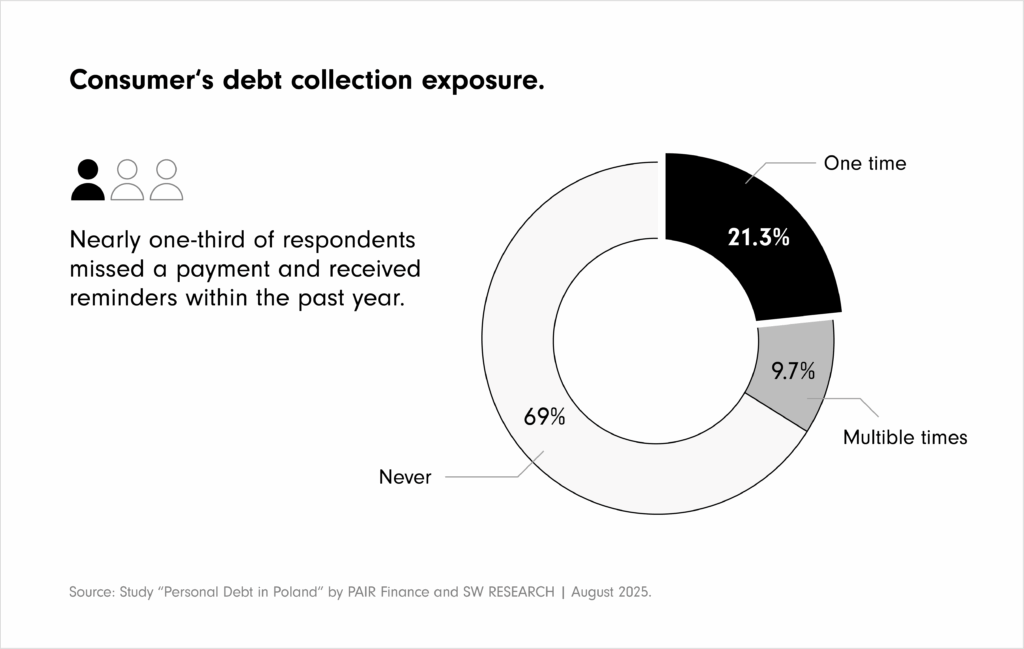

Warsaw, 29. October 2025 – Over 30% of adult Poles say they have had overdue payments and been contacted by a debt collection department in the past 12 months (21.3% once, and 9.7% multiple times). The most common reason for arrears is simple – forgetting to pay. When contacted by a debt collection agency, respondents prefer email, and when repaying debt, they most often would like to choose BLIK. These are the key findings from a new, representative survey by SW Research for PAIR Finance, a leading European digital debt collection fintech now operating in Poland.

Almost one in three respondents confirmed they had overdue payments and contact with a debt collection department in the past year (totaling 31.0%). The most frequently cited cause of the arrears was simply missing a payment deadline. “I forgot to pay” – over 20% of respondents gave this reason. This suggests that reminders and clear communication about payment deadlines can significantly reduce delays.

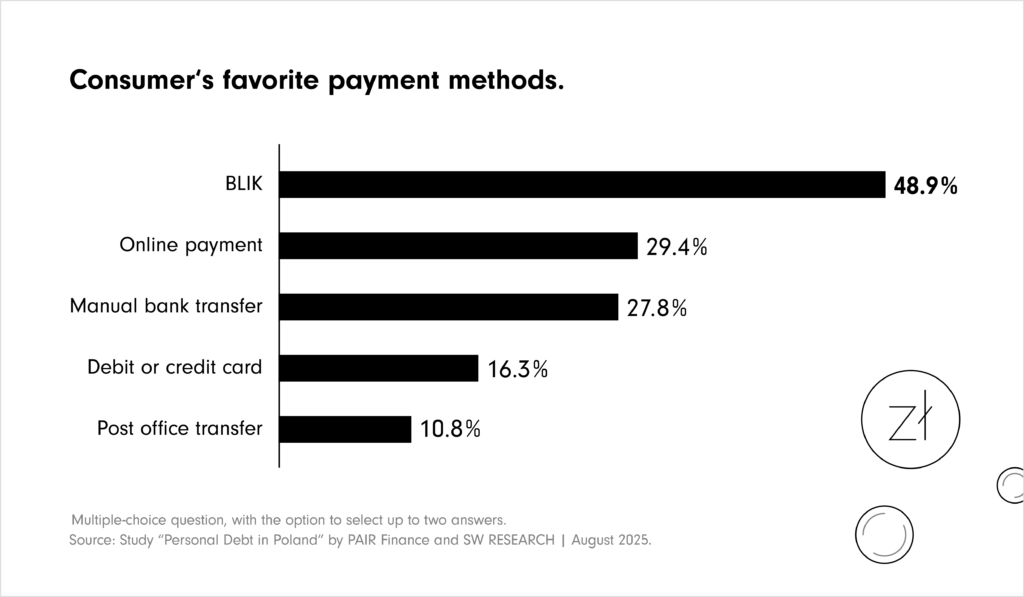

Communication and payment channels

If contacted by a debt collection agency, more than a half of respondents indicated digital channels: email – 37% and SMS – 22.4% as their preferred way of communication. A significant portion also prefers: phone calls – 33.3% and traditional mail – 24.3%. When it comes to repayment methods, digital options are a dominant expectation: BLIK – chosen by 48.9% and online banking – 29.4%. This clearly signals that fast, mobile, real-time payments can accelerate the path to settling debts.

What emotions does debt collection trigger?

Half of the respondents (50%) admit that contact with a debt collection agency causes anxiety or stress. One in three feels impatience and wants to resolve the issue quickly. A similar proportion reports feeling shame. This highlights the importance of tone and empathy in communication during the debt recovery process.

What motivates people to repay debt?

The top motivation for repayment is clear information about the amount and deadline: 42.2% cited this factor. This is followed by: a calm, human, and non-threatening tone of communication – 36.8%. Fear of consequences (such as court proceedings or being listed in a debtor register) motivates 31.4% of the participants.

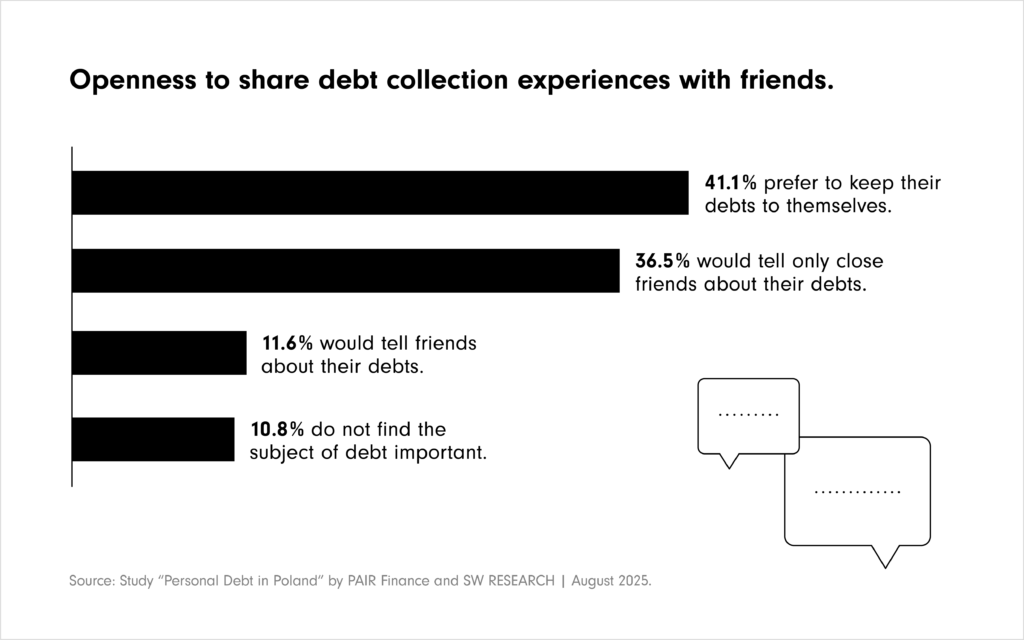

Is debt still a taboo topic?

Debt collection remains a sensitive subject for many Poles. Over 40% would not tell anyone they were dealing with a debt collection agency. More than 35% would confide only in close friends. Just 11.6% would admit to a friend that they had a debt or were contacted by a debt collector. Debt clearly remains a social taboo.

How is debt collection perceived?

A noteworthy conclusion is that a majority of respondents (65.1%) see debt collection as a useful process. However, a significant portion (22%) still finds it unpleasant.

Digital convenience and empathy: The new standard

“Polish consumers expect debt collection to be as smooth and digital as their everyday payments. Most missed payments are simply forgotten, so we’re making it easy to resolve them – clear communication, flexible options, and zero judgment. Our goal: take the stress out of debt collection and create a process that serves people, not works against them. It’s time for a new, customer-first standard.” – summarized Stephan Stricker, CEO of PAIR Finance.

“Debt collection is today about confidence and flexibility. The survey confirms that Poles value clear information, respectful communication, and fast, digital payment options like BLIK. Our Warsaw team is focused on making debt collection in Poland more convenient, and stress-free for everyone involved.” – said Michał Gębała, Managing Director of PAIR Finance Poland.

Expert commentary

SW Research Expert:

“One in three respondents experienced debt and contact with debt collection, and half report fear or stress – this shows just how sensitive this area is. At the same time, consumers clearly state what they need: transparent information, a calm tone, and the ability to pay quickly. This approach truly helps resolve arrears in a less stressful and more user-friendly way.”

About the study

The “Research Report” study was conducted by SW Research in August 2025 on a representative sample of N=1000 adult respondents. Some questions allowed for multiple responses and were directed at a subsample of those with experience in debt collection (e.g., N=310). All percentages may not total 100% due to rounding or multi-response options.