Europe-wide study: AI reduces emotional stress in debt collection by 36%

- A comprehensive analysis of 3,500 consumers in 11 countries proves that AI significantly lowers psychological stress.

- Trust in AI in financial dialogue is on a par with humans, while humans remain irreplaceable for empathy and fairness.

- Dr. Minou Goetze, Fresenius University of Applied Sciences Hamburg: “There is no one-size-fits-all strategy.”

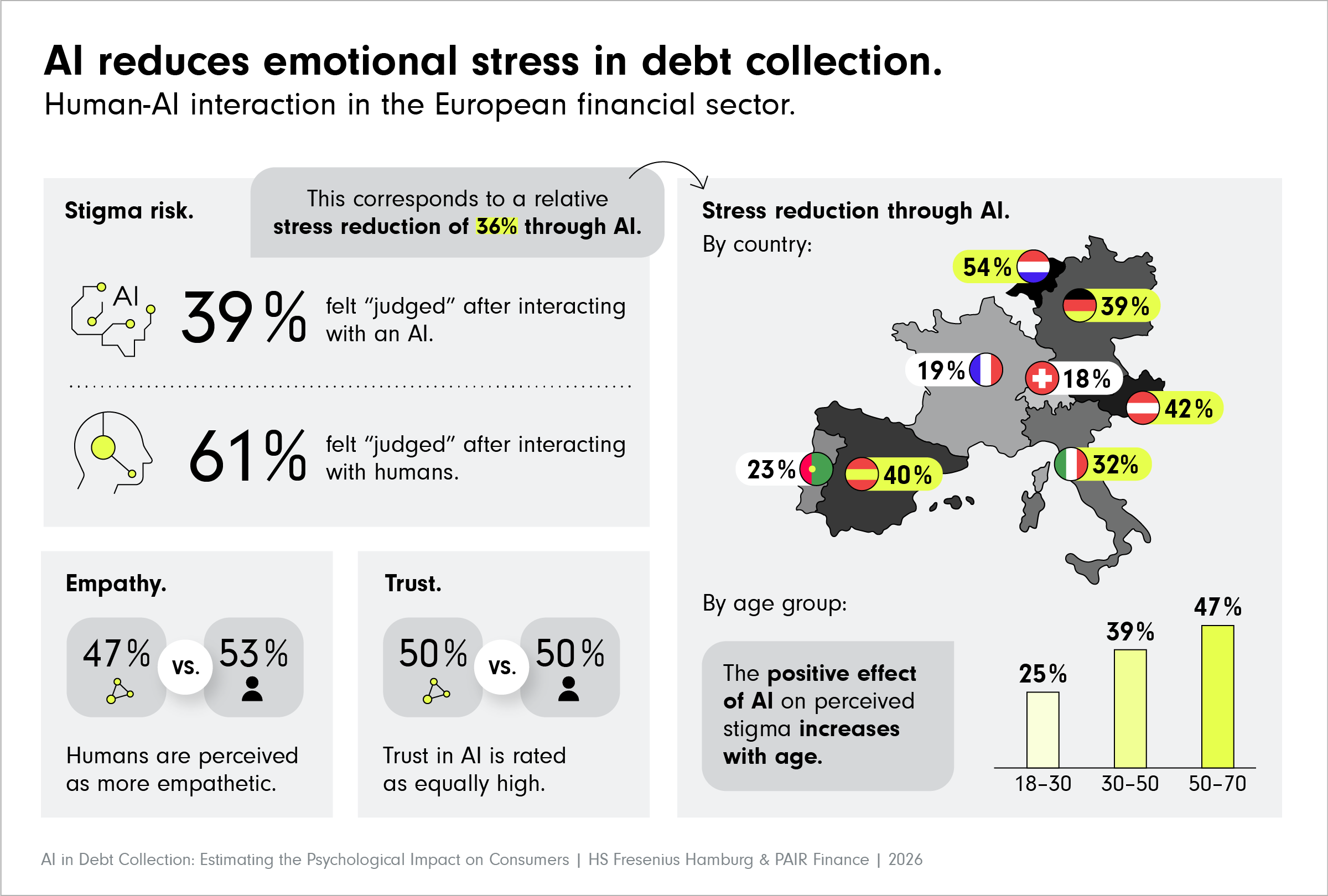

Berlin, 11 February 2026 – No one likes to talk about debt. The associated feeling of shame and judgement is often the biggest barrier to resolving financial difficulties. A new randomised study, commissioned by PAIR Finance (www.pairfinance.com) and conducted by the Fresenius University of Applied Sciences in Hamburg, now shows that Artificial Intelligence (AI) is a crucial factor in reducing this emotional burden. In the study, participants evaluated a simulated debt collection conversation, once with a human agent and once with an AI agent. The central finding of what is the most comprehensive analysis to date on the psychology of human-AI interaction in the financial sector, involving 3,500 consumers from 11 countries, is that contact with AI reduces the feeling of being judged by 36 per cent.

The most important findings at a glance:

- AI combats the stigma effect: The study finds that a major advantage of AI in financial communication lies in its psychological impact. While more than half (61%) of participants reported feeling judged after conversations with human agents, this figure dropped to just over a third (39%) after contact with AI. This corresponds to a relative reduction in emotional stress of 36%.

- The ideal AI scenario: The study shows when AI is most effective: when efficiency and speed are paramount, discretion is crucial for reducing feelings of shame, and trust needs to be maintained without deep emotional interaction.

- Trust remains stable: The myth that machines are less trusted is debunked. The level of trust in AI (50%) is identical to that in human agents (50%).

- Humans for empathy: People are perceived as more empathetic (53%) than AI (47%) and remain indispensable for complex cases.

Prof. Dr. Minou Goetze, Fresenius University of Applied Sciences, and head of the study: “Debt-related interactions are highly sensitive. Our study shows that AI changes not only the process but fundamentally the psychological experience of consumers. It has the clear potential to reduce emotional burdens such as stigma. At the same time, humans remain irreplaceable when it comes to the perception of fairness and empathy. The significant cultural and demographic differences that our data reveals make it clear: a one-size-fits-all strategy is not enough for financial communication in Europe. The key lies in a differentiated approach.”

Culture and demographics: Personalisation is key

A uniform approach for the whole of Europe does not do justice to the complexity. The study reveals significant differences:

- Age: The positive effect of AI on the perception of stigma increases with age. For those over 50, contact with AI reduces the feeling of being judged by almost half (47%), while the effect is significantly lower for those under 30 (25%).

- Gender: While there is hardly any difference in the perception of stigma in human interaction, men feel about 20% more judged than women after contact with AI.

- Countries: The risk of stigma is highest in the Netherlands (22%) and Germany (22%) with human interaction, and lowest in Italy (12%).

Dr. Sebastian Clajus, Head of Behavioural Science at PAIR Finance and co-author of the study: “People inevitably judge other people, whereas a machine is perceived more as a neutral, efficient tool. This psychological difference is the key to reducing feelings of shame and judgement. What’s important for us is that trust in the information does not suffer. Our task at PAIR Finance is to harness exactly this mechanism.”

Stephan Stricker, Founder and CEO of PAIR Finance:

“This study provides the scientific proof for what our success has long demonstrated in practice: the old approach of pressure and shame fails because it ignores consumer psychology. Our model is fundamentally different. We use technology specifically to resolve the vast majority of cases efficiently and without human intervention. This is not a contradiction to humanity; on the contrary. It creates the freedom for our experts to concentrate on precisely those complex cases where empathy makes the difference. This is how we scale efficiency and humanity at the same time.”

Today, more than 70% of cases at PAIR Finance are resolved purely technologically and without human intervention. The basis for this intelligent communication control is a database of over 10 billion data points. It enables the AI to understand the needs of consumers and to personalise the interaction in real time.

Study Methodology

The study, involving 3,514 participants from eleven European countries (Germany, Austria, Switzerland, France, Spain, Portugal, Italy, the Netherlands, Belgium, Poland, Sweden), provides a nuanced picture of the opportunities and challenges of using AI in sensitive financial situations. The data was collected from August to October 2025. Participants were randomly assigned to one of two groups and evaluated a simulated telephone call with either a human or an AI-based debt collection assistant in terms of fairness, empathy, efficiency, stigmatisation and trust. The sample was balanced by gender (52% male, 48% female) and age (average: 35 years).

Image material for editorial use available at:

https://pairfinance.com/en/media-kit-european-study-ai/