What's behind it:

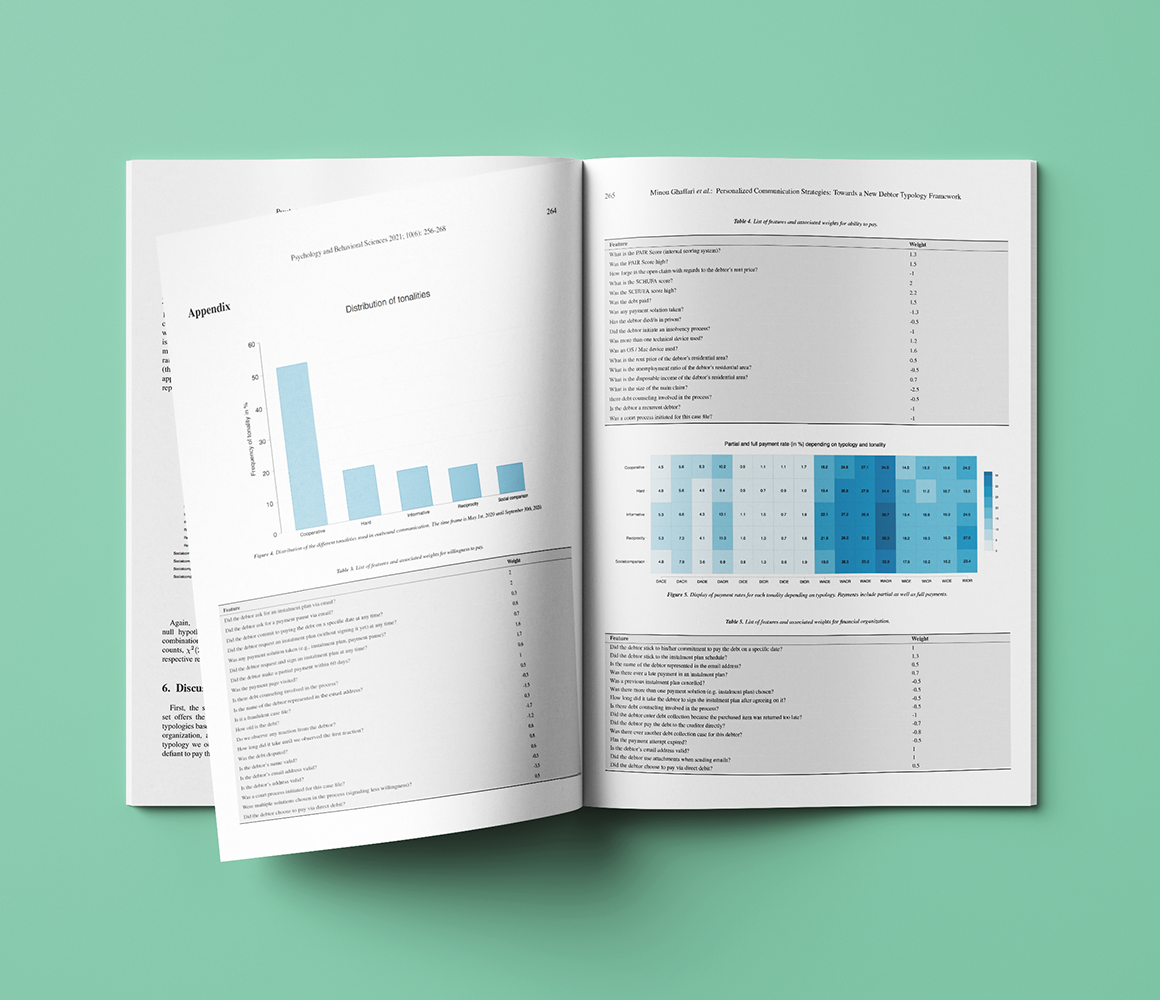

16 customer types react differently to the content and timing of digital messages.

AI, behavioural psychology & data science sustainably increase return rates.

Analysis of 400,000 cases and associated AI-optimised communication.

Four dimensions, each with two opposing poles, form the basis of the typology.

"There is a growing need to gain deeper insights into how people act when paying debts. PAIR Finance's study is a completely new and highly relevant extension of the existing approach to customer typology."

Prof. Dr. Christine Laudenbach

Behavioural economist

Behavioural economist