PAIR Finance Customer Typology Study: Great potential for personalized debt collection

- 16 customer typologies show serious differences in the reaction to the content and timing of a digital message

- Behavioral economist Prof. Dr. Christine Laudenbach, University of Bonn: « Highly relevant extension of conventional customer typologies »

- Triad of artificial intelligence, behavioral psychology and data science sustainably improves return rates for enterprise customers

Berlin, June 22 2021 – Online business is booming, and so are unpaid bills. The companies that make up the Bundesverband Deutscher Inkasso-Unternehmen e.V. (BDIU) returns six billion euros to the economy every year, and processes 20 million receivables to do so. Until now, little was known about both the personality types underlying online shoppers with late payments, and how to leverage insights into personality types to ensure the most successful out-of-court repayment.

In response to this open question, PAIR Finance—Germany’s leading fintech for AI-based debt collection and receivables management—presents the first study on a new customer typology for the digital age. At the Berlin-based technology company, the future of debt collection has been created around artificial intelligence, behavioral research, and data science since 2016. The survey, led by behavioral researcher Dr. Minou Ghaffari, evaluated around 400,000 anonymized individual cases and their associated AI-optimized communication in a retrospective view. The enterprise customers were from a wide array of the digital economy, including e-commerce, finance, insurance, mobility, shared economy and telecommunications.

Dr. Minou Ghaffari, Head of Behavioral Research at PAIR Finance: « Artificial intelligence, per se, is a black box. With our customer typology study, we shed light on the darkness and generate behavioral data in a readable form for the first time. Our new look reveals the increasing complexity in digital usage and unprecedented dynamics of individual consumer behavior in receivables management. »

PAIR Finance varies its communication strategy based on six levels: Channel, Style, Tonality, Timing, Frequency and Solution. This results in more than 30,000 different communication options. The customer typology study examined two of these levels, tonality and timing.

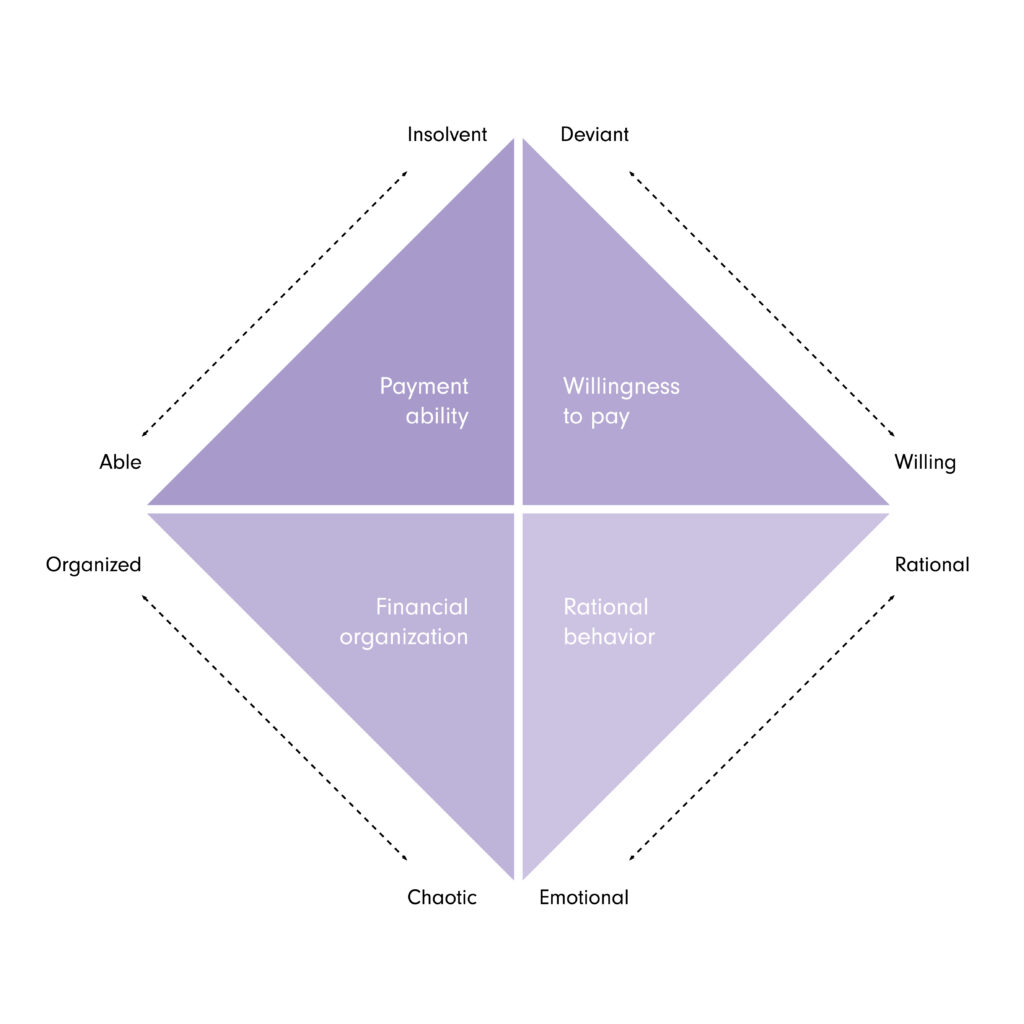

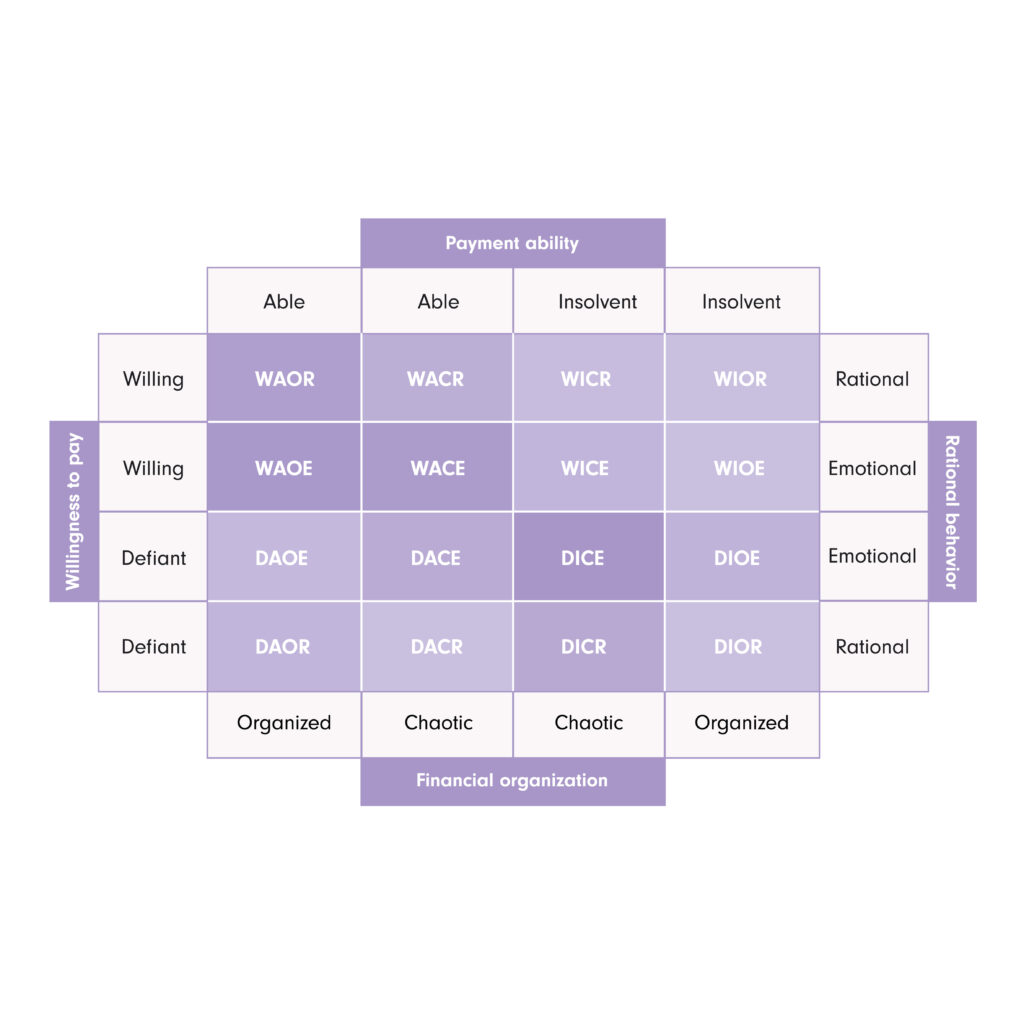

Furthermore, the study identifies four dimensions to define customer typologies. By splitting each dimension into two opposite poles, this results in a total of 16 customer typologies. The impact of tonality and timing on the willingness to repay outstanding receivables was analysed with respect to these 16 customer types.

The four different dimensions are: willingness to pay; ability to pay; financial organization; and emotional behavior. The first two dimensions— willingness to pay and ability to pay— have been previously studied within the field, and they define the four main debtor types used so far. The dimensions of financial organization and emotional behavior are new, developed and introduced by PAIR Finance. The study questions the hitherto common assumption of a perfectly rational person and incorporates personal behavior that reflects financial organization in the analysis. This expansion of aspects of a customer’s situation enables a much more detailed look at customers and correspondingly differentiated solution options.

Among the nearly 400,000 cases, five types emerged as by far the most common:

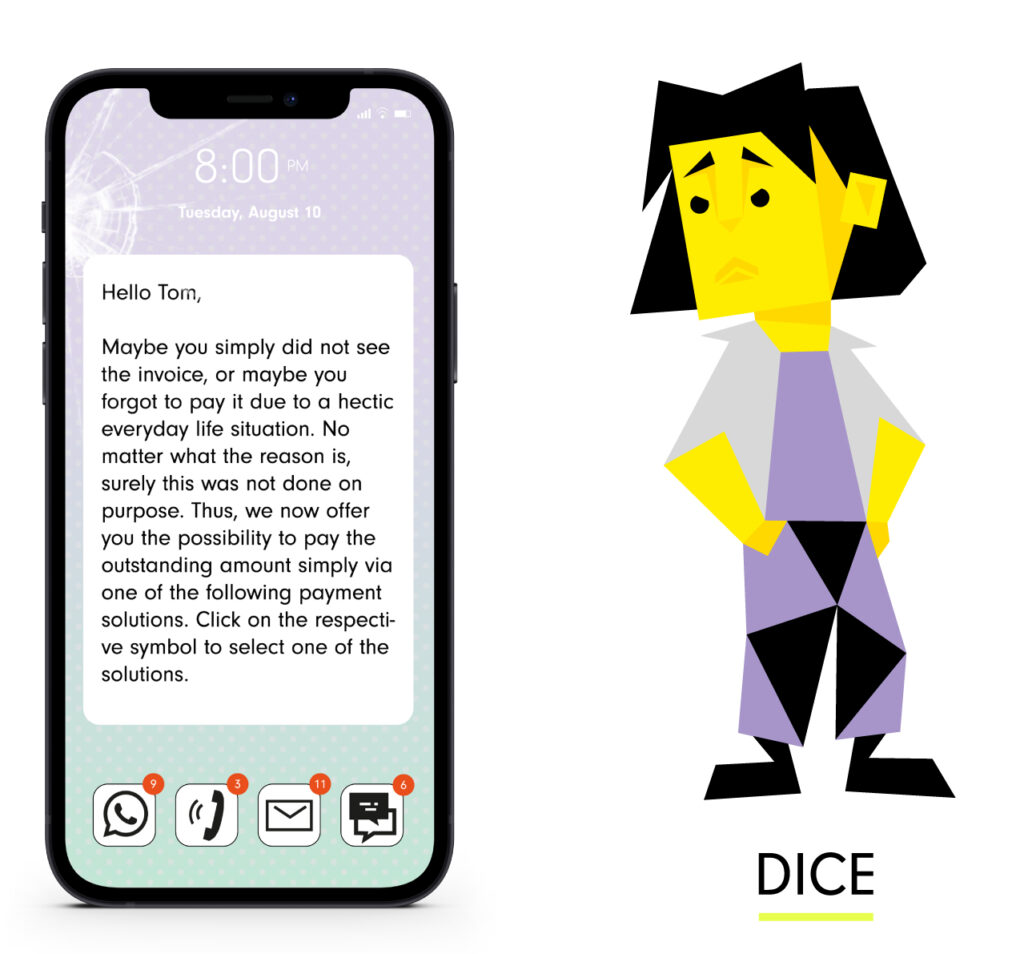

DICE (defiant, insolvent, chaotic and emotional), 19.4%: Typically, these are customers who are in a difficult financial situation and tend to reject any payment solution. They do not engage in any conversation with the collection agency. Even if efforts are made to reduce the fees for them.

—

WAOE (willing, able to pay, organized and emotional), 13%: These customers decide quite quickly to pay the debt. They are in a good financial situation and respond quickly to payment reminders but can be rather volatile in their communication.

—

WACE (willing, able to pay, chaotic and emotional), 10.5%: This type of customer tends to pay claims and they are in a good financial situation. However, they are not able to stick to payment plans, and they also tend to be emotional in their communication.

—

WAOR (willing, able to pay, organized, rational), 9.9%: This customer type is more likely to opt for a payment solution. He is in an appropriate financial situation, shows a digital affinity and makes rational financial decisions by paying in response to reduction offers.

—

DICR (defiant, insolvent, chaotic and rational), 9.7%: Typically, these are customers who tend to refuse any payment solution and are in financial distress. Also, they rarely engage in communication with the collection agency and frequently go into collection with large outstanding receivables.

—

Different types of customers react differently to the content of a message (tonality) and the time of day when it is sent. The following actions are counted among customer reactions: visiting the payment page; contacting; choosing a payment solution; and direct payment (payment of the total amount or partial payment). To trigger a reaction, a cooperative message (« Maybe you simply overlooked the bill, maybe you forgot to pay in the hustle and bustle of everyday life. No matter what the reason, we are sure it was not intentional ») combined with a send out at 12:00 noon is best for types DICE, WAOE and DICR. An informative tone (« We ask you to pay the open invoice now and for this we offer you the possibility to pay easily and conveniently through the following link ») at the same time works best for type WAOR. In the evening at 8:00 p.m., a reciprocal speech (« Company XY has gone to great lengths – we expect you to fulfill your obligation to the team at XY ») is most likely to elicit a response from WACE.

There is a growing need to gain deeper insights into how people act when paying debt. PAIR Finance’s study is a completely new and highly relevant extension of the previous approach to customer typology. The expansion of dimensions paints a much more nuanced picture of customers than before. »

Christine Laudenbach, Professor of Finance at Rheinische Friedrich-Wilhelms-Universität Bonn, has reviewed the study and comments.

Artificial intelligence is about to fundamentally change receivables management. It is the key to making debt collection an effective part of the customer journey. Our study shows: With rapidly changing consumer behavior, companies must rely on dynamic solutions that take individual behavior into account, especially in their communications. Otherwise, they run the risk of missing their targets. A multidimensional approach provides the best strategy to achieve the goals of out-of-court payout, retention and reputation in debt collection today

PAIR Finance founder and CEO Stephan Stricker

Image material for editorial use can be found here:

https://pairfinance.com/en/mediakit-typology-study/