SHS VIVEON concludes technology partnership with PAIR Finance

The new machine learning algorithm from PAIR Finance supports clients of SHS VIVEON when it comes to assessing potentially risky payment methods.

Munich, 7 October 2019 – SHS VIVEON, international provider of a software solution platform for the intelligent management of credit risks, is cooperating with receivables management and debt collection company PAIR Finance at the point of sale (POS). The aim of the cooperation is to use AI-based algorithms from PAIR Finance to optimise risk management for online purchases.

SHS VIVEON is offering its clients the innovative machine learning algorithm from PAIR Finance in line with its software solutions. As a first stage, SHS VIVEON is adding an innovative, AI-supported receivables management system to its platform which will fit in seamlessly with its digital business models. The second phase will use the PAIR Finance algorithm for the assessment of purchase processes, for example, assessing the credit-worthiness and volatility of purchasers. This will allow SHS VIVEON to support companies with the decision as to whether to offer risky payment methods or enter into risky contracts.

Another benefit of the cooperation is that, through the partners, clients no longer have to go through the hassle of transferring outstanding debts to PAIR Finance. There is an interface on the SHS VIVEON platform which gives them the option of sending their outstanding debts directly to PAIR Finance, thus ensuring a seamless handover between credit scoring, reminders and debt collection.

If a consumer who is currently within the debt collection process at PAIR Finance wishes to make a repeat purchase, the provider can also query the repayment probability for the previous debt with PAIR Finance during the checkout process. If the probability of repayment is high, the provider can continue to offer this consumer riskier payment options and avoid them cancelling the purchase.

“The partnership with SHS VIVEON allows us to tap into further links in the value creation chain,” underlines Stephan Stricker, Founder and CEO of PAIR Finance in Berlin. “This means SHS VIVEON customers can utilise a highly data-driven risk solution which is well established in the market and helps them make better decisions at the PoS.”

“Unlike the many traditional companies in the debt collection and claims management sector, PAIR Finance is a technology partner. “The combination of data-driven, digital debtor interaction with the latest findings from behavioural research is what makes the difference,” explains Dr Jörg Seelmann-Eggebert, Member of the Executive Board at SHS VIVEON. “This algorithmic knowledge is outstanding within the purchase process and allows differentiated, customer-centric decision-making.”

ABOUT SHS VIVEON

SHS VIVEON AG is an international provider of software solutions for the intelligent management of credit risks. The aim is to make all decisions which have an impact on turnover and risk along the company’s digital “lead-to-cash” process more sustainable and more efficient.

All the software solutions from SHS VIVEON are embedded into the modular software solution platform. It covers all sections of the customer process, from the lead process through quotation and contract phases to customer development and receivables management. The software and consultancy services can be adapted to the specific requirements and seamlessly integrated into existing IT infrastructures. The solutions thus support the digitalisation strategy of companies of all sizes in industries such as financial services, retail, e-commerce, industry, telecommunications and energy. The headquarters of SHS VIVEON AG are in Munich and it has branches in Dusseldorf, Mühldorf am Inn, Stuttgart, Vienna and Zug. The company is listed on M:access on the Munich stock exchange. Further information: www.shs-viveon.com

ABOUT PAIR FINANCE

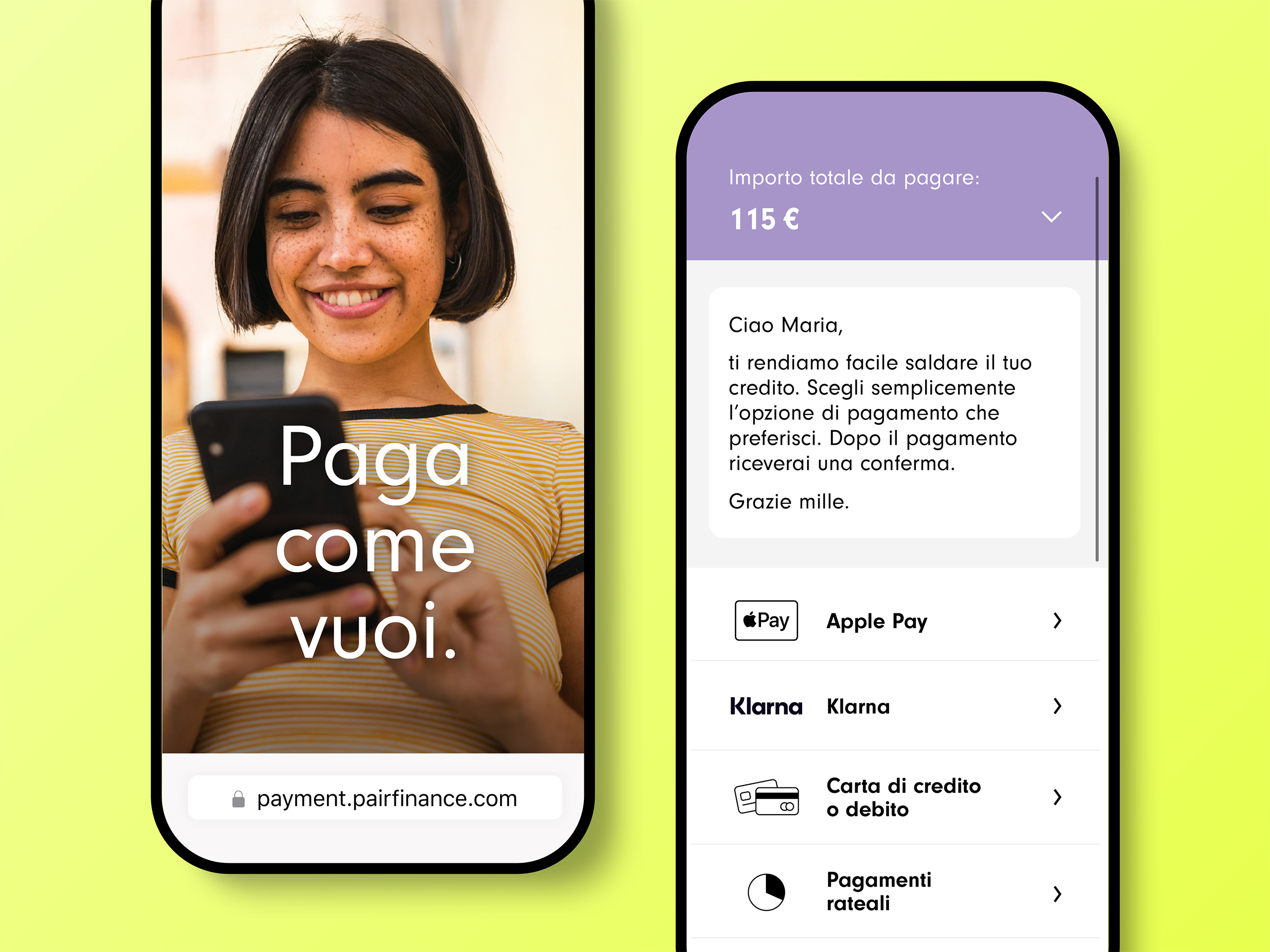

PAIR Finance is the leading AI-based company in the debt collection and receivables management sector. By means of digital communication channels and behavioural analytics, PAIR Finance processes outstanding debts from defaulting customers in a way which is more efficient and more customer-focused. The company was founded in early 2016 and offers its services to more than 250 corporate clients from a range of industries in Germany, Austria and Switzerland. The team is growing rapidly and currently stands at 70 employees led by founder and CEO Stephan Stricker.