- Powerful new feature set with “predictive recovery”, “recovery funnel” and customer-centric metrics

- Real-time charts show KPIs on recovery progress

- Attractive, responsive state-of-the-art design

More than ever before, finance professionals and departments are under intense pressure to deliver fast insights as well as clear and reliable financial reports while driving business performance. They have a significant impact on business success. How that impact is measured is undergoing a fundamental shift in the age of machine learning and “predictive” algorithms.

What metrics should finance teams at digital companies keep in mind when managing receivables? How can finance KPIs deliver real value in measuring success and, in turn, business success? In the following, we provide answers to these questions and introduce our next generation digital collections dashboard.

Financial Business Intelligence.

The PAIR Finance collections dashboard is a management tool that helps track all relevant financial KPIs of receivables management: Repayments and accounts receivable can be tracked here in detail to meet and exceed a department’s or company’s financial goals. This increases productivity and ensures a stable financial environment.

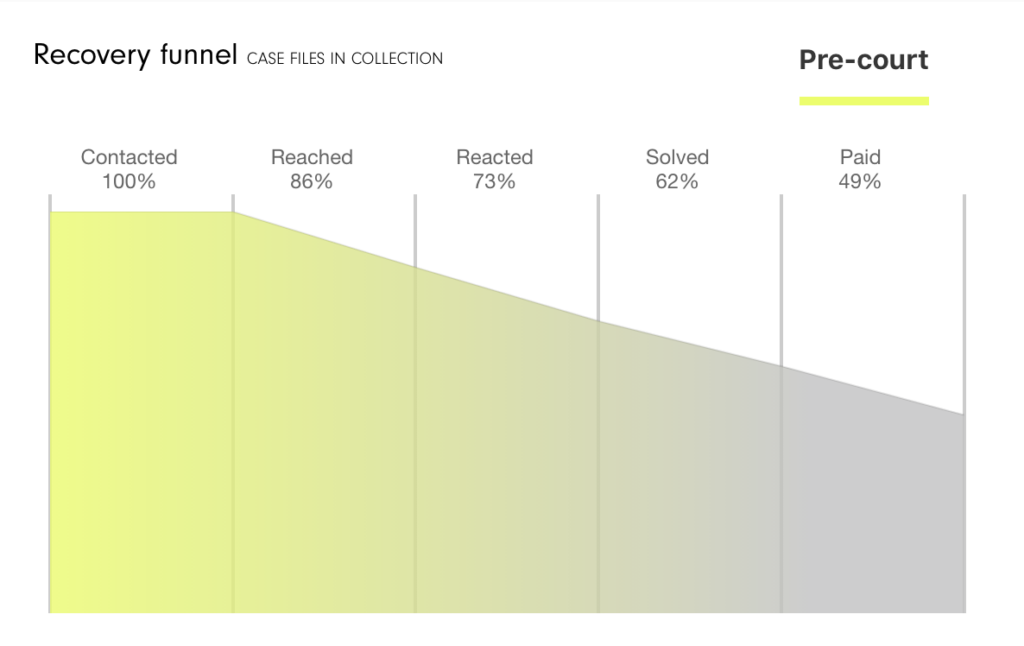

By using our dashboard, our enterprise customers can quickly track and measure all data accurately and in real time. Numbers can be validated faster, and financial details can be delved into as much as necessary. New: For the first time, the “Recovery Funnel” presents a granular overview of interactions with the consumer – contact, accessibility, response, resolution, payment. Rich analytics and intelligent graphs make discrepancies immediately apparent. This creates new opportunities and eliminates tedious traditional means of data analysis and reporting.

PAIR Finance offers the best collection solution we could find on the market. The excellent client dashboard was one reason of our decision for the fintech: the intuitive interface and the effective provision of KPIs convinced us. Getsafe wants to make insurance better without conditions. PAIR Finance supports us with the best of both worlds – a first-class client experience and an efficient KPI tool.

– Michael Oberste, CFO Getsafe

Data Quality.

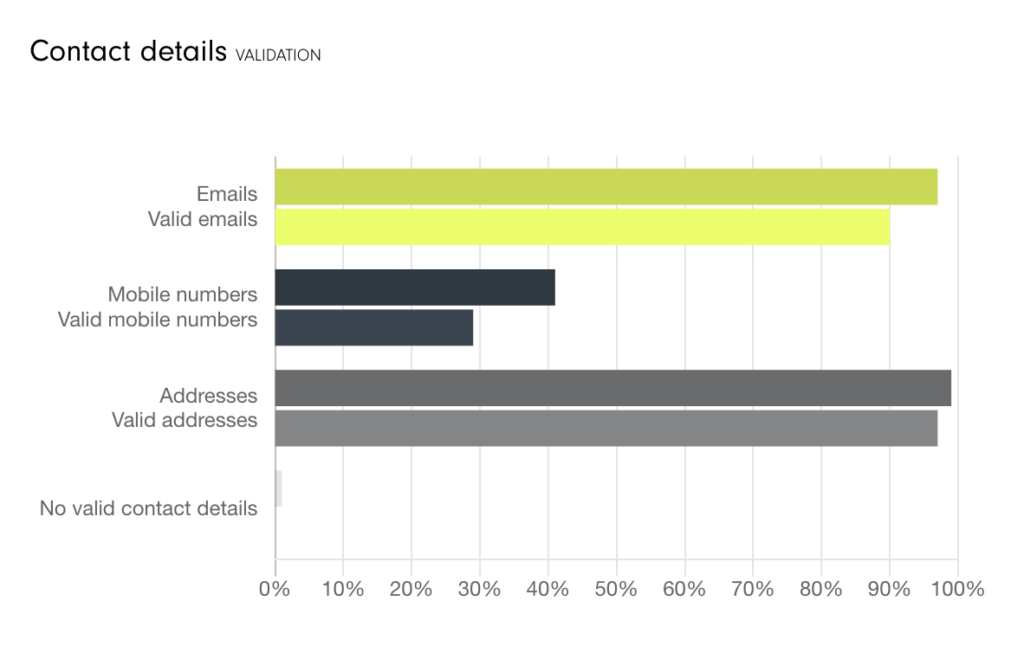

Today, outstanding receivables are not only delivered more quickly by e-mail, SMS or WhatsApp than by post, but they also demonstrably reach the recipient exactly where he or she looks several times a day anyway: on their smartphone. More than 70% percent of consumers respond to a digital message from PAIR Finance.

AI-based debt collection can only be successful with data that must be of sufficient quality. PAIR Finance works primarily for companies for which digitization is at the core of their future orientation and which can deliver this data quality to a high degree. But there are differences within the industries: While e-commerce already has a wide range of data points, the insurance industry only has e-mail contacts for 20-25% of its customers.

If data records are incorrect or incomplete, subsequent enrichment, supplementation or correction becomes necessary in receivables management. In the new dashboard, the quality of the data supplied is shown for the first time and provides our corporate customers with conclusions about unused potentials.

Predictive recovery.

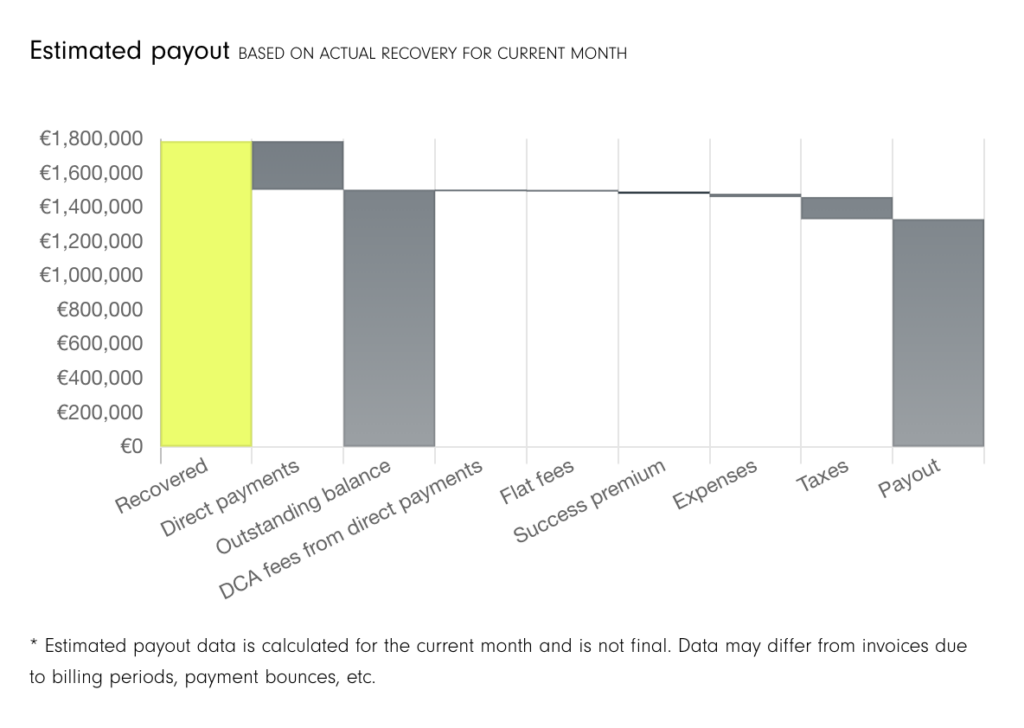

Often, KPIs are tracked primarily to provide retrospective analysis. But digital companies need more intelligent key performance indicators. PAIR Finance’s new Performance Monitoring, therefore, not only provides a look in the rear-view mirror, but also relies on predictive indicators: the new “predictive payout” section provides finance teams working with PAIR Finance Analytics with the expected payback amount at one glance.

Next-generation predictive algorithms will be incorporated into the planning and design of business processes in more and more companies in the future. PAIR Finance will provide more predictive indicators going forward. Data-driven companies that leverage these advances and integrate predictive KPIs will enjoy significant competitive advantages.

Customer-centric KPIs.

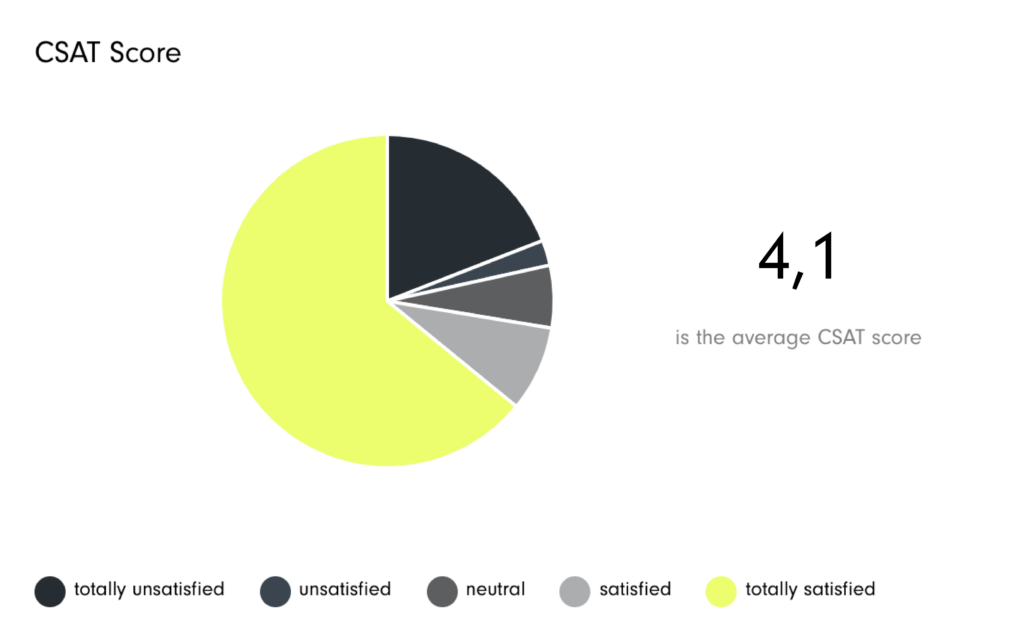

“The best experience wins” could be the motto of pioneering companies like Apple or Slack. But customer centric KPIs are only slowly finding their way into the world of key performance indicators. Today, the decision-making power of customers should also be reflected in a performance-oriented financial strategy. It is essential to anchor the customer centricity factor in the KPIs in a target-oriented manner to enable successful action control. PAIR Finance Analytics monitors the so-called CSAT score. This indicates how consumers rate PAIR Finance on a scale from 1=unsatisfied to 5=very satisfied. In the new “Retention” section, business customers can also find an overview of co-marketing activities (e.g., number of vouchers issued after payment).

Most companies have now recognized the great importance of a consumer-oriented approach in all areas of the company and are increasingly integrating this insight into their KPIs. Today, for example, two-thirds of the KPIs applied are already customer-centric. This represents a significant evolution in corporate focus, as traditionally KPIs have been heavily influenced by financial metrics.

Click here for the next generation digital dashboard.

Enterprise customers can find the login to their dashboard here. You don’t have an account yet or you are not yet a PAIR Finance customer? Get in touch with us here.