Buy in full, pay in installments – this is the well-known principle of payment by installments. Payment by installments is also a popular payment option in debt collection. PAIR Finance now offers its installment payers the option of paying the individual installments completely digitally. With the new “Splitpayments”, the fintech from Berlin is setting another important signal for more digitalization and customer orientation in receivables management.

Payment procedures and payment processes must meet many requirements in order to make a positive value contribution for all stakeholders. These include target group acceptance, usability, convenience, security and image. Payment by installments offers exactly this and, according to a study by ibi research (in German), is becoming increasingly popular with end consumers. In the retail sector, it is regarded as a sales driver, and consumers also want greater flexibility in paying outstanding invoices. This is because there is not always the financial leeway to settle a receivable immediately.

The digital installment payment plan in 1 minute

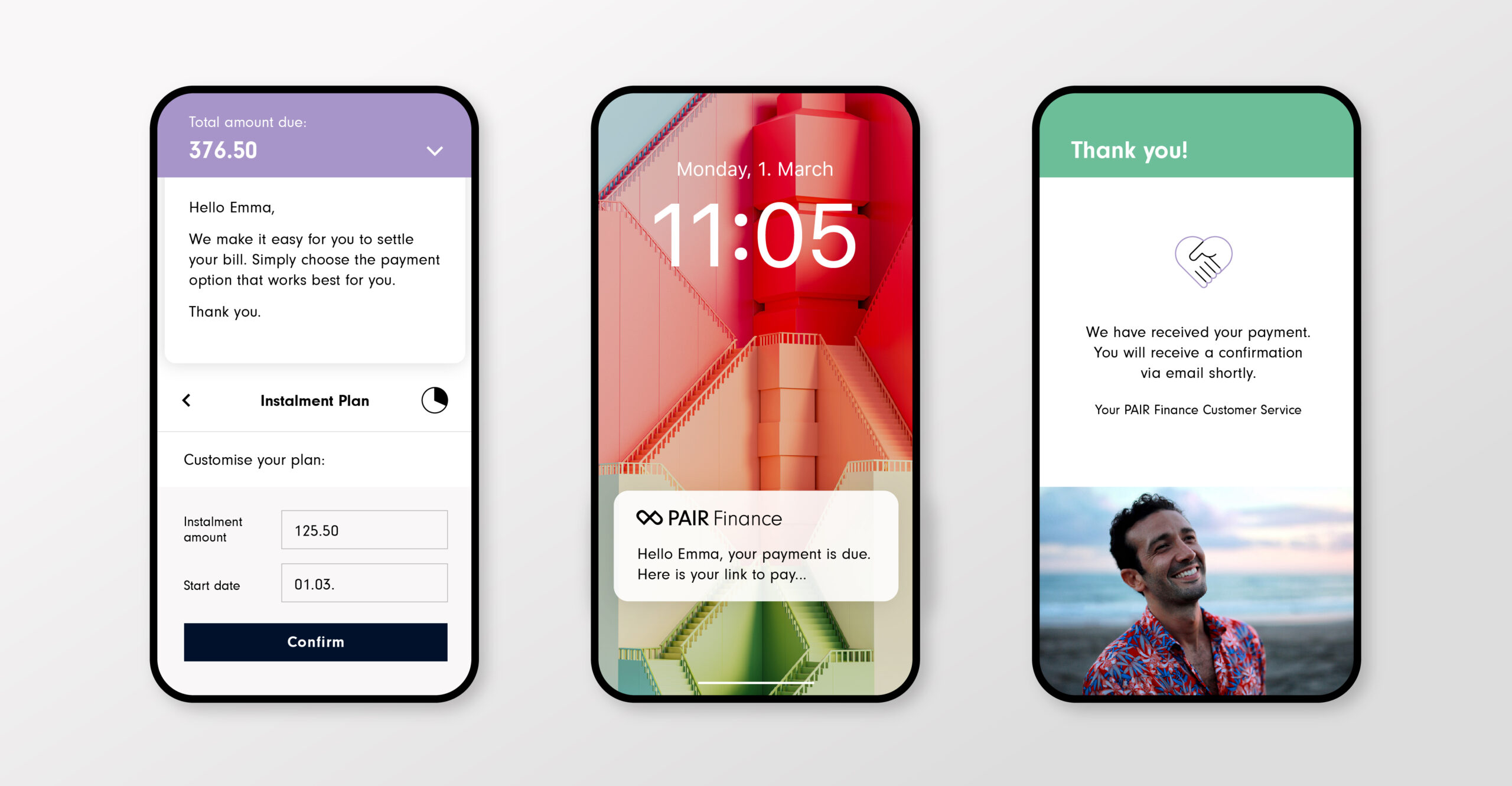

In such a case, a payment in installments might be helpful. 20 percent of consumers already use it on the PAIR Finance platform. In less than a minute, a consumer can independently put together and complete a legally binding installment payment plan on their cell phone. A novelty in the industry.

Payments without media break – the new split payments

Usually, in debt collection, installments must be paid by bank transfer. This is a manual process that is not only prone to errors, but also quickly forgotten, which often leads to payment cancellations. Consumers can now not only create the installment payment plan digitally, but also pay the individual installments with their smartphone using the split payment function. Push messages via SMS, e-mail or WhatsApp act as friendly reminders when the monthly installment is due. Via split link and with just a few taps, the due installment is settled with the usual payment partners Paypal, Klarna Sofort or Apple Pay – faster, easier and safer than ever.

Opportunities for consumers and corporate customers

Founder and CEO Stephan Stricker sees the flexibilization of payment options as an important step towards providing consumers with the best possible support in settling outstanding debts. The new payment method will also considerably increase the effectiveness of digital debt collection: “We are experiencing an increasing relevance of the topic of installment payments and are pleased to be able to offer an attractive solution. We want to help every consumer to get out of debt successfully and quickly. With the new payment procedure, our goals are clearly achieved: a higher realization rate and more customer satisfaction. We will continue to develop our payment offer further”. Thanks to the new digital payment option for individual installments, Stephan Stricker expects an increase in the fulfillment rate of payment promises of more than 10%.

Would you like to learn more? Christian Zingel, Chief Sales Officer, and his team are looking forward to hearing from you.