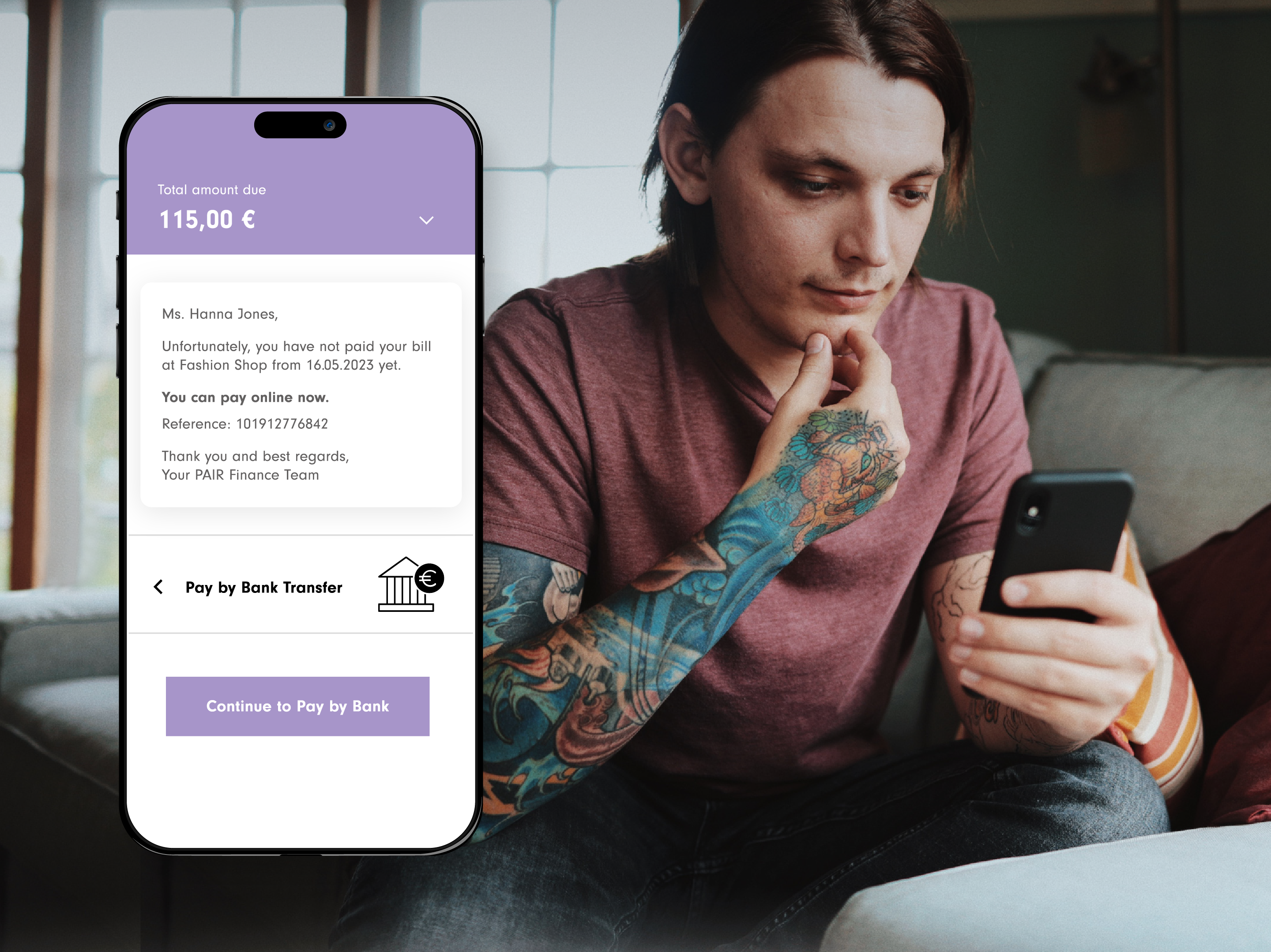

Recently, consumers have found a new payment method at PAIR Finance: PaybyBank with Open Banking Payments. Let us introduce you to the new payment option.

A common problem for consumers when making payments in debt collection is that the bill cannot be paid through the preferred and convenient channel. This is because debt collection companies often offer a limited variety of user-friendly payment methods. This makes it less likely that the outstanding amount will be paid quickly or at all. In the worst case, consumers are charged additional late fees.

On the other hand, a simple and seamless user interface with many payment options increases the likelihood that the overdue bill will be paid on time. “PAIR Finance is committed to continuously improving its payments platform for consumers,” says Stephan Stricker, CEO and founder of PAIR Finance. “As a supporting partner, we enable the most popular, simple and innovative payment methods. I am therefore very happy about the launch of this new, state of the art payment method”.

These are the benefits of PaybyBank:

Convenient and mobile first.

The direct link between the company and the bank allows payments to be made in the familiar banking environment. No manual effort is required to enter payment details. There are no more mis-entries or problems with the allocation of consumer payments.

Faster than many other payment methods.

The PaybyBank account-to-account payment is made in real time, which is much faster than traditional bank transfers, that often take several days. Money is transferred from one account to another in a matter of seconds. The immediate confirmation of the payment also gives consumers and businesses a guarantee that the payment will be executed. This improved cash flow eliminates the possibility of transaction chargebacks.

Secure.

PaybyBank takes place within the personal banking system, giving consumers security and confidence. Those who choose this payment method are automatically offered the most advanced and appropriate authentication method, such as biometrics e.g. Face ID or their own banking portal login. Strict security standards help protect personal and financial information.

Transparency for more control.

Today’s digital consumers want more control over their finances. This applies to every payment interaction, whether it’s an everyday expense or a debt collection bill. By having direct access to their personal bank account, consumers can better monitor their finances. This gives them more transparency and control over their spending and income.

A roll-out of the PaybyBank payment method to other PAIR Finance markets will take place in the coming months. An overview of the participating banks in Germany can be found here, remarkably covering 95%+ of the banked population.