AI Fintech PAIR Finance expands into Italy with new office in Milan

- Italy, the third-largest economy in the Eurozone, offers significant potential for innovation and growth in digital debt collection

- From the outset, companies from a variety of sectors are relying on PAIR Finance

- The new Milan office enables targeted business development and strengthens local presence in this strategic market

Berlin/Milan, 14 October 2025 – PAIR Finance, Europe’s leading digital debt collection platform, has announced its expansion into Italy. This market entry follows the company’s success in ten European countries and marks the highly anticipated launch in Italy. As part of this expansion, PAIR Finance has opened a branch office in Milan to ensure optimal support for Italian clients.

A Strategic Market in Transition

Italy, as the third-largest economy in the Eurozone, holds major strategic importance. The Italian debt collection market has traditionally been shaped by strong regional differences and bureaucratic hurdles. The enforcement of outstanding claims often involves lengthy court proceedings and paper-based processes, which place a burden on both businesses and consumers. Digital solutions have so far only been introduced in isolated cases. In particular, when handling numerous small claims of up to 500 euros, there is often a lack of fast and automated processes.

Stephan Stricker, CEO and founder of the PAIR Finance Group, says:

“We want to transform the debt collection industry across Europe, and Italy is a key part of our growth strategy. We are therefore excited to support Italian companies with high-volume claims and to help them unlock their full potential. This is precisely where our strengths lie, as we have seen in comparable markets. The demand for efficient and customer-focused approaches is enormous, both from international and local companies. The fact that we are launching with ten clients from different sectors underlines the great trust in our model.”

Modern Solutions and Clear Differentiation from Traditional Providers

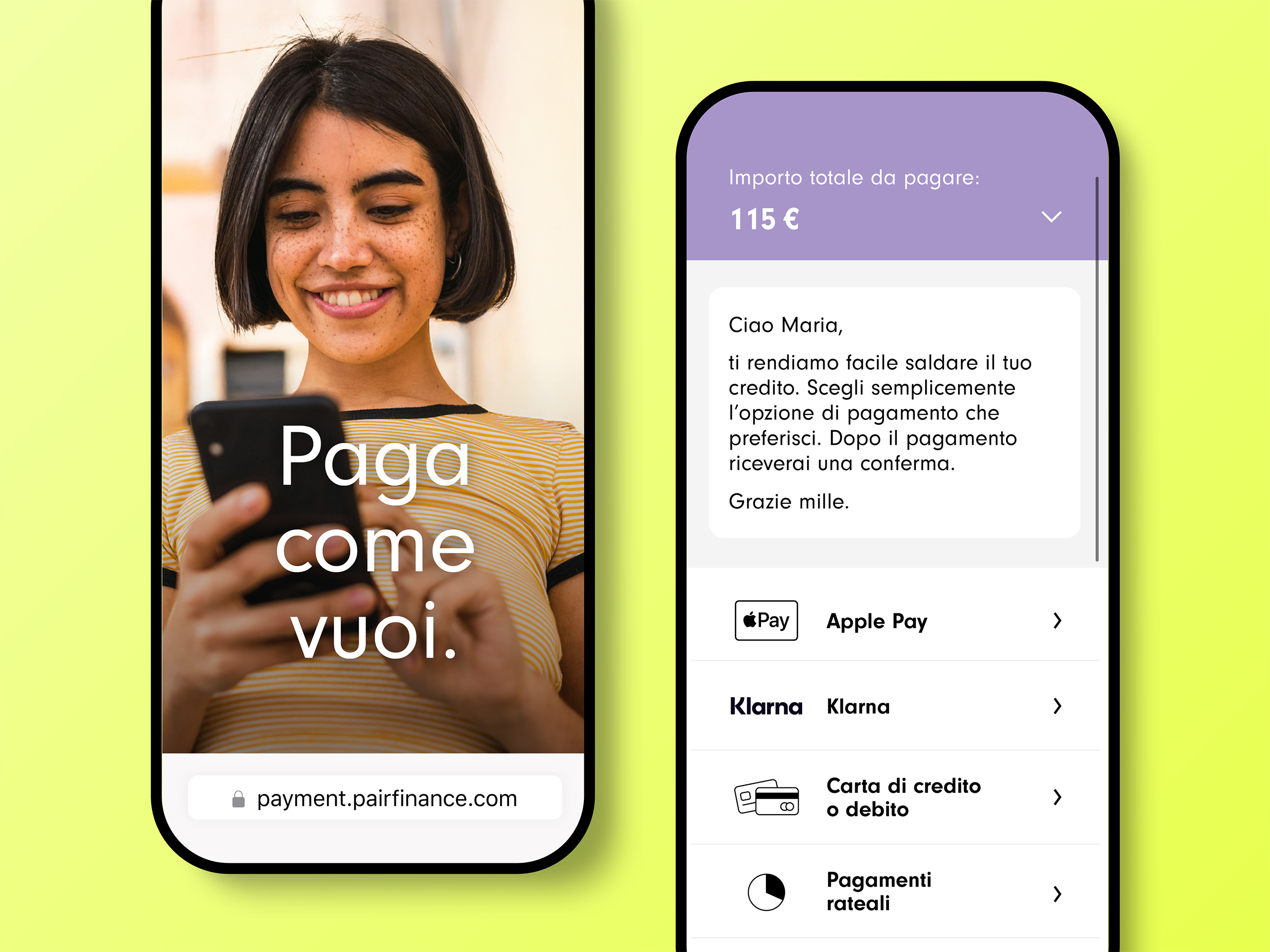

PAIR Finance offers businesses and consumers modern, AI-based communication and payment solutions, built on advanced data analytics and behavioural science. The company already works with renowned partners such as online retailer Zalando. One third of the 320-strong team is dedicated to innovation and tailored communication in the fields of technology and behavioural science. PAIR Finance’s proprietary platform processes more than 10 billion data points and analyses 30,000 communication strategies, enabling every message to be individually crafted and solution-oriented. Flexible, locally popular payment methods such as Bancomat Pay, as well as communication that takes regional specifics into account, are central elements of the approach.

Unlike traditional debt collection agencies, PAIR Finance places particular emphasis on respectful, fair, and above all highly personalised communication, with the aim of raising consumer awareness more quickly and finding an amicable solution together – before legal action becomes necessary. This highly personalised approach results in significantly higher recovery rates – on average around 15 per cent more than traditional providers – faster settlement of claims, and above-average customer satisfaction.

From Cash to AI: Italy’s Digital Transformation

In recent years, Italy has made great strides in digitalisation: fibre optic coverage now exceeds 70%, reaching EU levels, while according to the Banca d’Italia, 2024 saw, for the first time, more than 60% of all transactions carried out cashlessly. When it comes to the use of artificial intelligence in business, Italy still shows limited momentum: according to the European Commission, only about 5% of Italian companies used AI in 2024 – less than the European average of 8%.

PAIR Finance aims to actively drive this development forward by helping companies and consumers make receivables management more efficient, transparent, and customer-focused through innovative, AI-based solutions.

Image material for editorial use can be found at: https://pairfinance.com/en/media-kit-italy/