PAIR Finance scoops 4.5 million and attracts new, strategic investors

- THE DIGITAL CLAIMS MANAGEMENT COMPANY RECEIVES 4.5 MILLION EUROS IN EQUITY CAPITAL FROM VARIOUS INVESTORS, INCLUDING ZALANDO, IN A ‘SERIES A’ ROUND OF FUNDING.

- PAIR FINANCE IS USING THE NEW CAPITAL TO EXPAND ITS DATA AND MACHINE LEARNING-BASED TECHNOLOGY AND REINFORCE ITS MARKETING STRATEGY.

It is an investment which is bringing a breath of fresh air to the debt collection industry. Berlin-based fintech company PAIR Finance has received around 4.5 million euros from strategic backers and active financial investors in a first round of financing, known as Series A. The round involved, among others, new investors Zalando, the HitFox Group and a number of leading business angels from German industry (e.g. Maximilian Zimmerer, former chairman of Allianz, Mark Stilke, former CEO of Immoscout). Existing capital investors, such as company builder FinLeap, yabeo Capital and Ey Ventures, have also reinforced their confidence in PAIR Finance with renewed investment.

Kai-Uwe Mokros, VP Payments at Zalando: “PAIR Finance stands for the future of claims management: digital, efficient, customer-focussed. Both the technology-driven approach and the expertise of the team convinced us to invest. We are very much looking forward to continuing this successful cooperation.”

Stephan Stricker, CEO and founder of PAIR Finance: “We are proud of the confidence our investors have placed in us. PAIR Finance has set itself the goal of making claims management in Germany and Europe customer-friendly and digital. The new partners will allow us to reach further milestones and grow our company.”

PAIR Finance is an important partner for its clients in order to conclude the relevant end-to-end process successfully. Quick, efficient recovery of outstanding debts allows PAIR Finance not only to improve payment cycles, but also to help companies to adjust their risk management systems in order, in turn, to achieve higher turnover and build up further products and services for their brands.

Gerrit Seidel, Managing Partner at yabeo and previously Executive at billing and payment service provider Klarna A.B.: PAIR Finance embodies radical change in a traditional industry. The approach based on behavioural theory combined with state-of-the-art and socially accepted communications channels are what makes them successful.

More than 150 companies from the e-commerce sector and the digital services sector through to large media houses are already using claims management services from PAIR Finance. In future, the aim is to tap into new markets undergoing a digital transformation, such as banks and insurance companies. PAIR Finance will primarily utilise the investment to build on its marketing strategy and the technology it has developed in-house based on artificial intelligence.

How PAIR Finance works

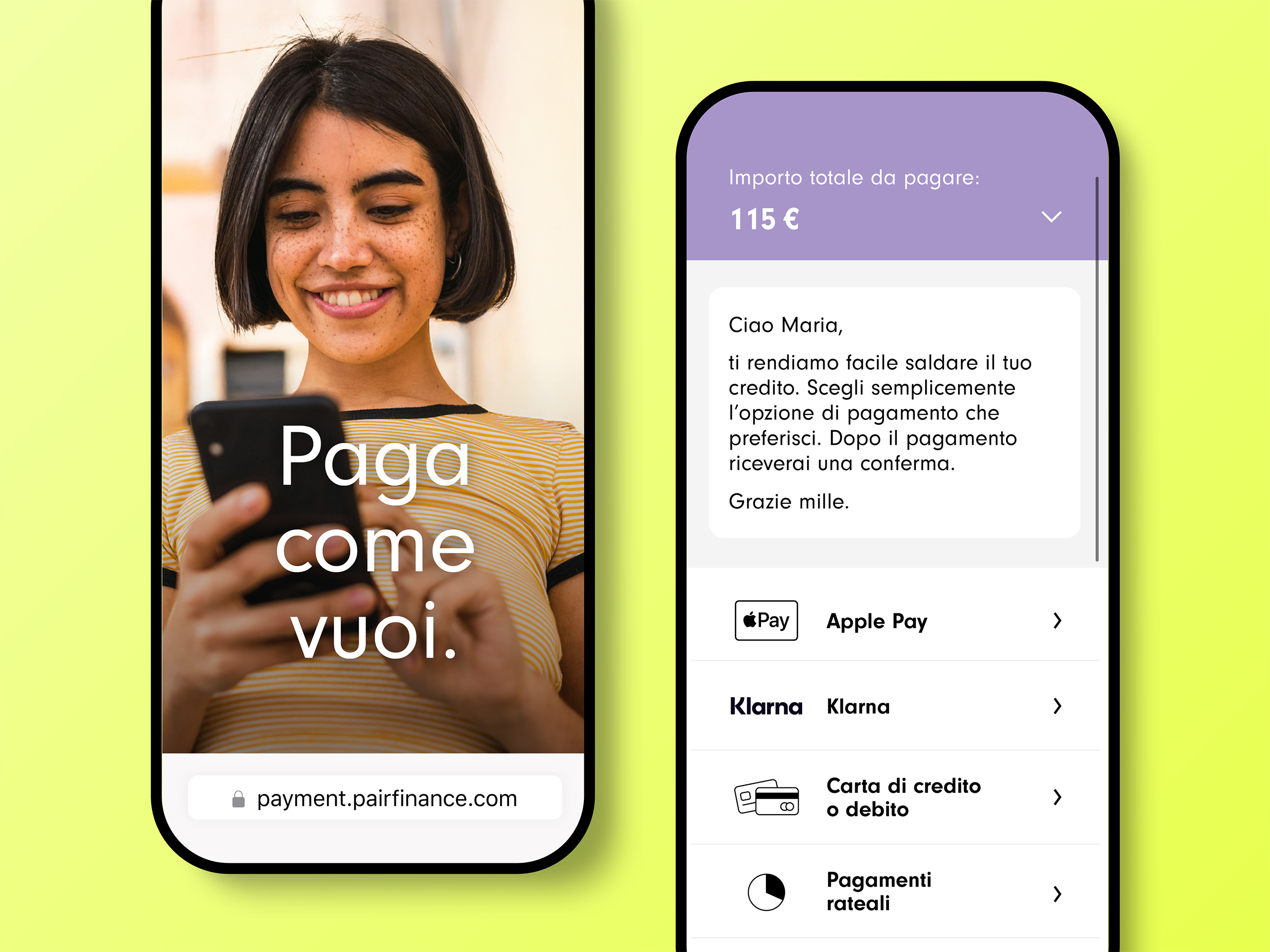

A self-learning algorithm takes into consideration a wide range of data collected before and during the interaction with the consumer who has gone into arrears, which is continuously processed and analysed on the basis of stringent German data standards. Based on the latest behavioural research and psychology, the customers are typologised, addressed individually and offered tailored solutions. The aim is to make them aware and offer pro-active assistance in resolving the payment problem and settling the outstanding debt. As well as the content and tone of the approach, the optimum channel, timing and frequency is also determined. PAIR Finance contacts customers via e-mail, text message or messenger services. The digital means of communication makes it possible to send an individual link with the payment request that the customer can use to settle their outstanding debt, also digitally.

This means there are no changes in media format for the consumer, they can complete the whole process online in just a few clicks. The digital channels also reach the consumer considerably faster. Debt collection reminders sent by post mean the consumer contact is only made after one or two working days, by e-mail or text message it takes an average of ten minutes, as smartphone users generally look at their phones about 150 times a day. PAIR Finance does not work with a solicitor prior to court proceedings in order to prevent reminders coming across as threats, although the tone and intensity of the communications is adapted based on the customer’s reaction in order to recover debts efficiently.

This means that outstanding invoices are normally settled within just a few days. The automatic processing of debt collection management saves time and money during the process, so it can be completed quicker and more cost-effectively.

Respectful handling of the consumers throughout the whole process ensures that the customer relationship is not permanently damaged and, once the payment has been made successfully, the consumer can continue to use the company’s services.

PAIR Finance is transforming debt collection into a win-win situation for the company: on the one hand, consumers pay outstanding debts quicker without long drawn-out, expensive processes and legal proceedings, on the other hand, they are retained as customers for the company.

About PAIR Finance

PAIR Finance is a technical, data-driven company in the debt collection and claims management sector, which efficiently collects debts from defaulting customers through digital, customer-focussed communications methods and behavioural analysis. The company was founded in Berlin in 2016 and already has around 150 German corporate clients. The team currently stands at 20 employees led by co-founder and CEO Stephan Stricker.