A new era in debt collection: PAIR Finance revolutionises customer service with generative AI

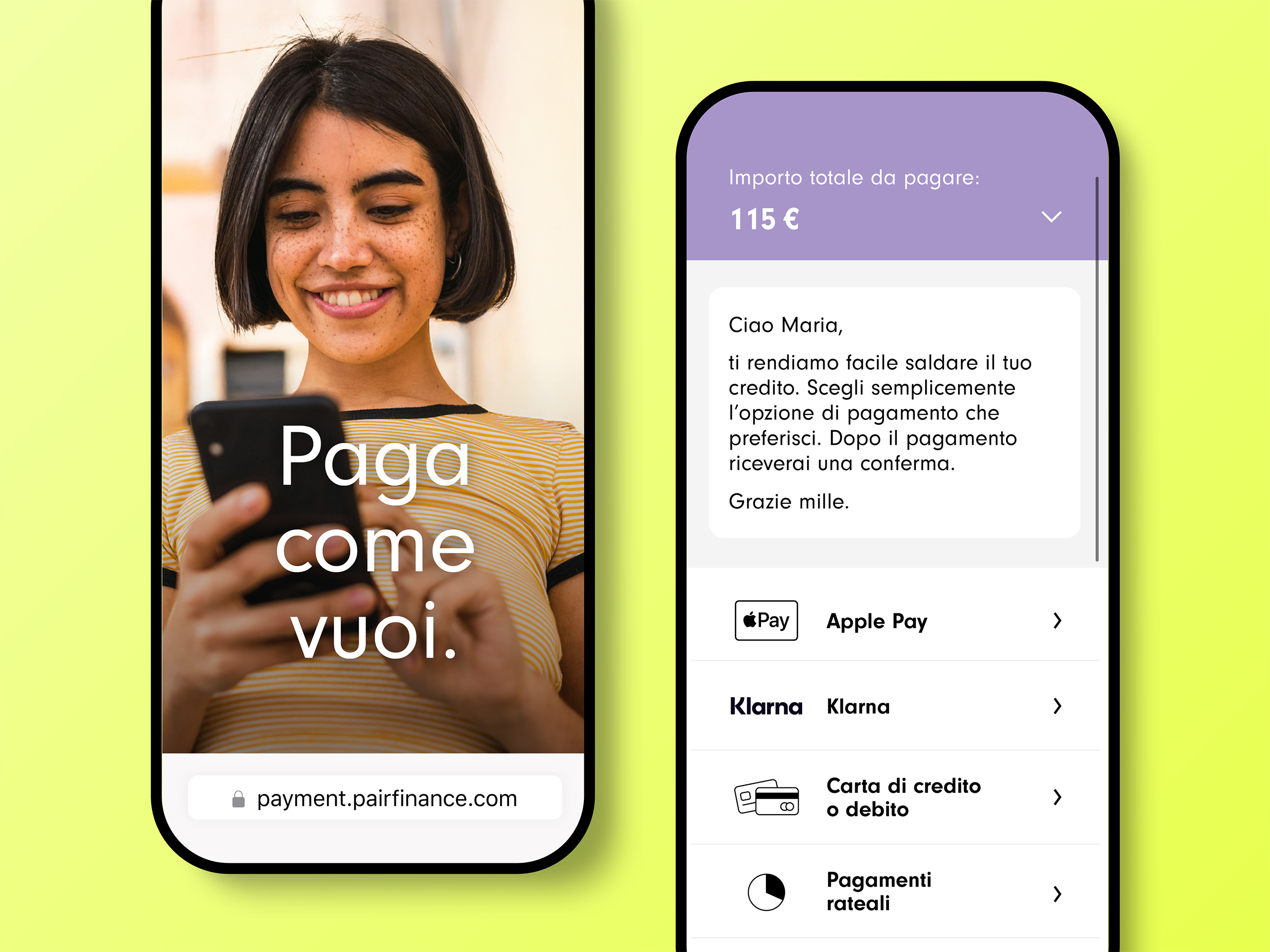

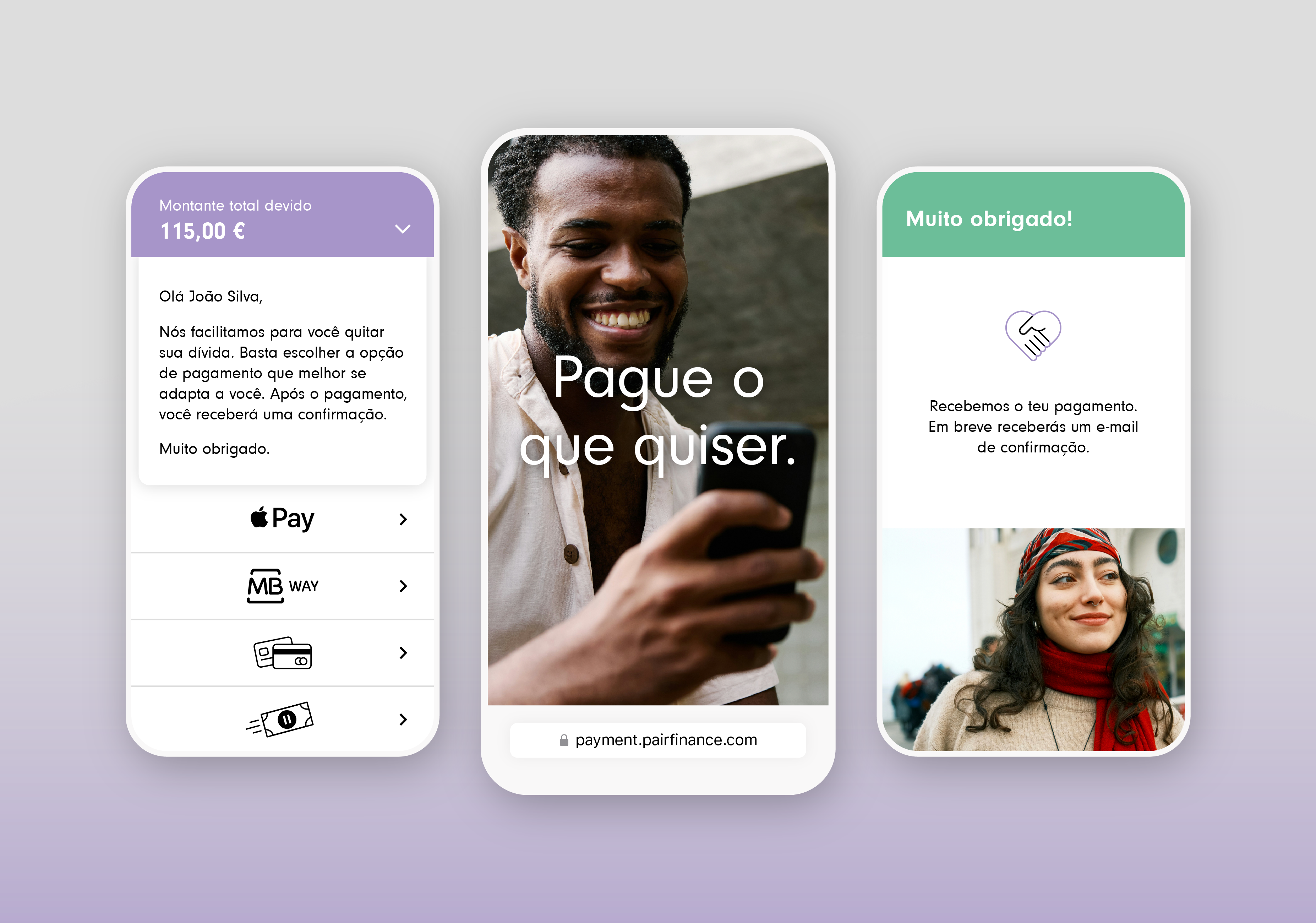

- PAIR Finance is building Europe’s most comprehensive AI-based debt collection process using its own technology to optimise receivables management and create the most user-friendly experience for consumers.

- From now on, generative AI will ensure significant efficiency gains and excellent support experiences in customer service.

- More than a third of all first-level consumer queries are handled by the new AI technology – 24/7 and in multiple languages.

Berlin, 19 November 2024 – PAIR Finance, Europe’s leading technology company for fully digitalised debt collection, today announced the launch of its new generative AI technology based on Llama 3 in customer service. PAIR Finance is embarking in a new era in the debt collection industry. Significant benefits for consumers and business customers are already emerging.

At PAIR Finance, artificial intelligence has been at the heart of product development since the company was founded. Since 2018, the fintech has been adding value by using reinforcement learning to address each customer type individually to find out-of-court solutions for outstanding invoices. By developing different typologies and an individual approach by the in-house team of behavioural researchers, it is possible to sensitise people to respond to an outstanding claim. This reduces costs for consumers and optimises recovery rates.

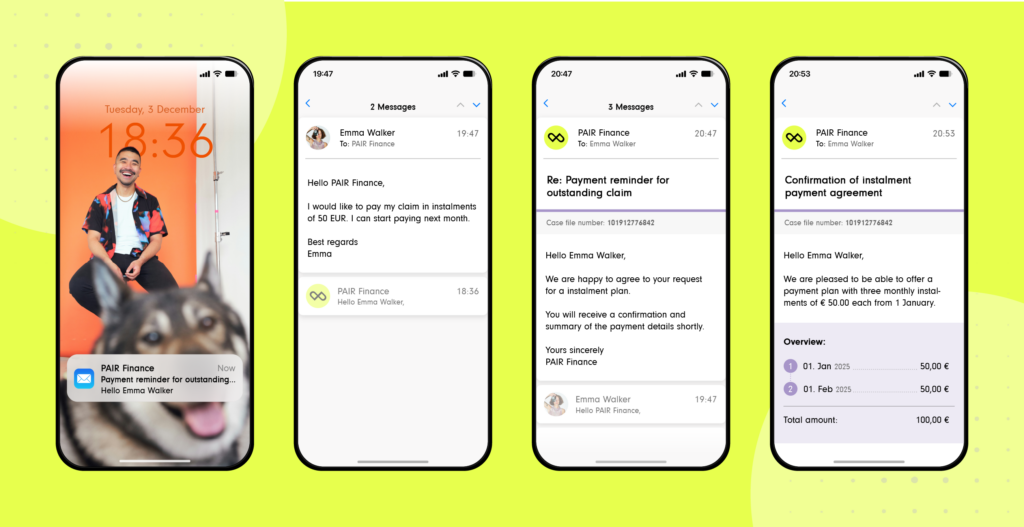

Now, for the first time, PAIR Finance is using generative AI to significantly improve the communication of queries during the debt collection process. The AI, which has been developed specifically for debt collection, already recognises and categorises 92% of incoming first-level queries, such as requests for payment in instalments, payment suspensions or disputes. Based on the content, the AI decides whether an automated response can be provided. For more complex queries or those requiring specialist human expertise, consumers are routed to qualified agents who provide a personalised solution.

After one month of use, the figures clearly show the success:

- The generative AI technology reliably finds solutions to more than a third of all first-level consumer queries – by the end of the year, it should be able to answer half of all first-level queries.

- Generative AI has quadrupled the rate at which requests are handled.

- Response times are dramatically accelerating, with consumer wait times reduced to one hour.

- Faster customer service has improved customer satisfaction by 10%.

- The recovery rate has increased by 2-3%.

- The new AI technology provides personalised 24/7 support in 8 countries and 6 languages.

In total, around 90% of all successfully resolved cases at PAIR Finance are resolved using the AI technologies of reinforcement learning and generative AI.

“Our mission is very clear: AI first. We have been achieving significant efficiency gains with this technology for years. Generative AI is now revolutionising our customer service and taking it to a whole new level. Consumers are getting the help they need faster and more accurately, while we are significantly optimising our operational processes,” explains Stephan Stricker, founder and CEO of PAIR Finance. “Our staff can now focus their expertise on complex cases. This breakthrough strengthens PAIR Finance’s position as an innovation leader in the international debt collection industry.”

AI governance in daily business

PAIR Finance aims to be a pioneer not only in the technical development of AI, but also in the implementation of AI governance. This combines the requirements of the AI Act, the GDPR and the company’s own values to create a quality benchmark that goes beyond the current regulations. An interdisciplinary team is working on the governance strategy with external data protection officers.

High-resolution images are available free of charge to the media: https://pairfinance.com/mediakit/